Currency exchange traded funds (ETFs) could reflect the news that Mexico’s peso strengthened the most since 2002.

Investors bet against the gap between the U.S. and Mexican benchmark lending rates widening and signaled attention toward the nation’s fixed-income securities.

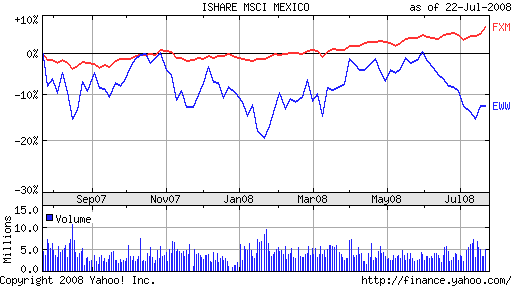

The peso rose for the third day in a row, increasing 0.9% to 10.0365 per dollar yesterday, from 10.1284, previously. This gain was the biggest among the six most traded currencies in Latin America. Will the CurrencyShares Mexican Peso Trust (FXM) keep saying “Ole!”? Year-to-date, it’s up 12.1%.

Before you break out the tequila, beware that Mexican policy makers are raising borrowing costs for the third consecutive month when they meet in August in an attempt to help offset inflation, reports Valerie Rota for Bloomberg. Banco de Mexico will raise its benchmark rate to 8.25%, one-quarter percent higher. Will the Mexcian economy be in danger of a slowdown?

Although the economy is under pressure from a U.S. slowdown, it rose a surprising 3.4% in May. Noel Randewich on Reuters reports that retail sales are up 2.5% for the month, while wholesale sales are up 3.6%, another indication of healthy spending among the Mexican consumers.

The iShares MSCI Mexico (EWW) could reflect the changes and growth taking place in Mexico’s economy, too. Year-to-date, it’s down 2.6%.

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.