Commodities exchange traded funds (ETFs) took a wallop yesterday after news about the U.S.’s crop outlook was improved.

They plunged by the most since March, as grain futures fell, while rain from Colorado to Pennsylvania brought fresh hopes for crops, reports Millie Munshi for Bloomberg. Corn, wheat, soybeans and cotton all fell by the maximum amount allowed by U.S. exchanges.

Those numbers follow a record month for June, in which corn rose 26% and soybeans rose 15%. Copper, cocoa, gold, silver and coffee also fell as worries about supply tapered off

What does it mean? Is this a bump in the road, or the start of a downtrend? We’ll have to wait and see on that one, but always be sure to have your exit strategy handy, no matter what happens.

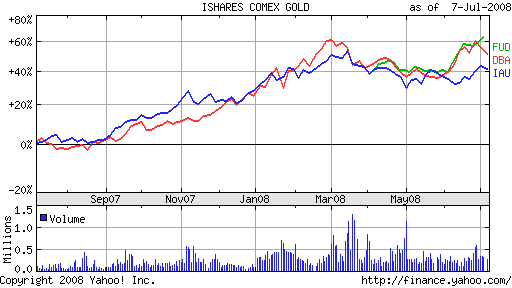

- PowerShares DB Agriculture (DBA), up 21.3% year-to-date

- iShares COMEX Gold Trust (IAU), up 10.8% year-to-date

- iPath Dow Jones-AIG Cocoa Total Return Sub-Index (NIB), launched June 24

- UBS E-TRACS CMCI Food (FUD), launched April 4

For full disclosure, some of Tom Lydon’s clients own shares of DBA.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.