Arch Coal (ACI) reported that its profits tripled in the second quarter, stoking the coal exchange traded fund (ETF).

The company attributed the profits to soaring global coal prices and tighter supplies, reports Jim Suhr for the Associated Press. Arch Coal also raised its earnings forecast for this year.

In the most recent quarter, the company sold 34.4 million tons of coal, up from 33.3 million tons in the same period last year. The reports are just the latest numbers showing signs of strength in the sector. Peabody Energy (BTU) also announced this week that their profits in the second quarter doubled.

Coal demand is on fire: China has idled more than 60 plants, because inventories have fallen to less than a three-day supply. The demand for the fuel has also given new life to U.S. coal exports.

Two other coal companies are readying to making their earnings announcements: Massey (MEE), on Aug. 1, and Walter (WLT) on July 28.

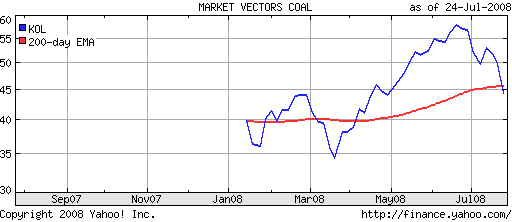

Market Vectors Coal (KOL) is up 11.3% since its Jan. 15 inception. Arch is 4.9% of its holdings; Peabody is 7.8%; Walter is 4.4% and Massey is 5.6%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.