Financial exchange traded funds (ETFs) are getting off to a solid start this morning after Bank of America announced earnings that were better than expected.

The news raised hopes that the wounds of the credit crisis might finally be cauterizing. With Bank of America’s numbers, that means four of the country’s five largest banks have reported earnings that have beaten expectations, reports Joe Bel Bruno for the Associated Press. Bank of America (BAC) said its profit fell 41%, mostly because mortgage-related losses offset by businesses in other areas of the bank.

Other financial sector earnings expected this week include:

- American Express (AXP): Today, after market close

- Wachovia (WB): July 22

- SunTrust (STI): July 22

- Washington Mutual (WM): July 22

- Ameriprise Financial (AMP): July 23

On Friday, options trading in the KBW Regional Banking (KRE) picked up, suggesting that more pain is ahead for the sector, reports Doris Frankel for Reuters. About 187,000 puts and 7,702 calls changed hands, 50 times the normal volume.

Puts are a way to protect an existing stock position, or to bet on weakness. It gives an investor the right to sell at a given price and time. A call, on the other hand, is a right to buy the stock.

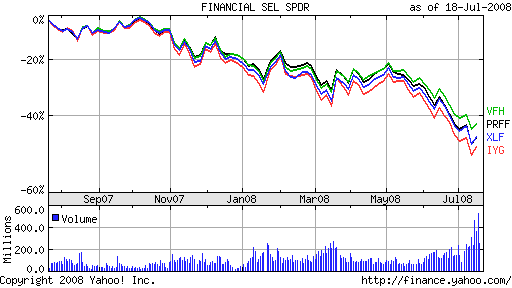

Among the ETFs trading higher this morning include:

- Financial Select Sector SPDR (XLF): down 28.7% year-to-date; Bank of America is 7.8%

- iShares Dow Jones US Financial Services (IYG): down 28.6% year-to-date; Bank of America is 8.8%

- Vanguard Financials (VFH): down 24.9% year-to-date; Bank of America is 7%

- PowerShares FTSE RAFI Financials (PRFF): down 28.4% year-to-date; Bank of America is 7.1%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.