As stock and exchange traded fund (ETF) prices decline, dividend yields are on the upswing. But are some too high to be safe?

There are still good yields (yield is the annual dividend divided by the stock price) to be found by investors who can discriminate between the good and the too-good-to-be-true. Analyst Howard Silverblatt, expects the recent contagion of dividend cuts and suspensions to spread to more companies whose earnings are too weak to support their payouts.

Mike Hogan for Barron;s explains that there are good places to start looking for companies who have staying power for decent yields. S&P 500 Dividend Arisoctrats is the best place to start a search. Its line-up for 2009 includes 52 members of the S&P 500 Index that have increased dividends every year for the last 25 years; its companion, the S&P High Yield Dividend Aristocrats, is made up of the 50 stocks with the highest yields among the Aristocrats.

Hogan caution that even the Aristocrats can run low on cash. Gannett (GCI), Pfizer (PFE), U.S. Bancorp (USB) and General Electric (GE) all have cut their dividends this year.

The average yield of the Aristocrats, at the low end of a 2%-to-4% range most years, has recently ticked up to 4.2%, compared with 4.57% for all S&P 500 dividend-payers, and around 3% for 10-year Treasury bonds. The bad news? Higher yields in the overall S&P reflect falling share prices more than increased dividends, illustrating that it’s tricky to pick winners.

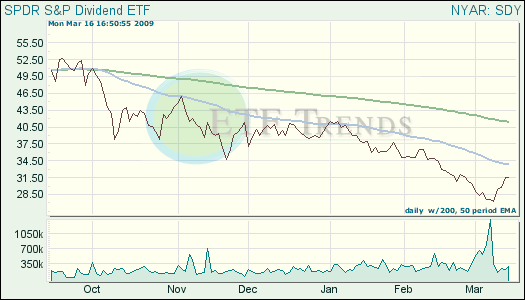

- SPDR Dividend ETF (SDY): This fund targets just the high-yield Aristocrats. It’s down 22.2% year-to-date; up 14.6% over one week. It yields 7.25%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.