It is no secret that Asian economies have been hit hard by the economic downturn, but just how hard can be gauged by the plummet in Chinese exports, as the country has become the barometer for both the region and related exchange traded funds (ETFs). There are bits of good news in here, though.

Reasons for Optimism. Mike Pienciak for The Motley Fool says that “recession” is a word that hovers around descriptions of the country’s economic forecast. But he notes some good points about the emerging economy:

- The implementation of the second part of its stimulus package, which includes $2.5 billion on health and education spending

- A $124 billion spending package focused on providing health care for 90% of citizens by 2011

- Reduced interest rates and reduced minimum down payments on homes

For 2009, many would say not to put the cart before the ox. The economic risk and the overall economic landscape are not doomsday, however, there is much uncertainty and the outlook is fogged. Global growth is now expected to come in at a meek 0.5%, and China’s prospects have been cut from 8.5% growth to 6.7%.

Continued Decline. Joblessness and social unrest are two results of the sharp slowdown in the growing Chinese economy. As the underlying fundamentals continue to eat away at the country’s growth, the region is also experiencing a decline. The 17.5% decline from a year earlier was worse than most analysts had projected and could dash hopes among some economists, reports Bettina Wassener for The New York Times.

Mistaken Bottom. Numbers based on recent initial purchasing mangers’ surveys and bank lending data had led some analysts to believe a bottom had been hit. Economists were quick to point out that the numbers released by the government customs office were heavily distorted by the fact that this year the weeklong Lunar New Year, China’s most important holiday, reports Ariana Eunjung Chu for The Washington Post.

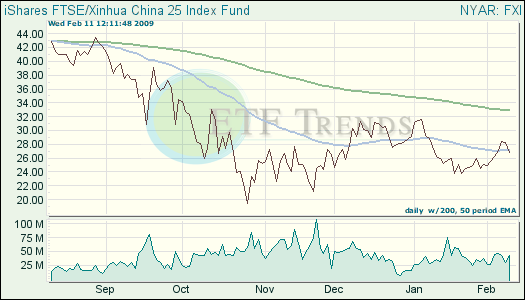

- iShares FTSE/Xinhua Chines 25 Index (FXI): up 1.9% over past three months; up 5.2% for the week

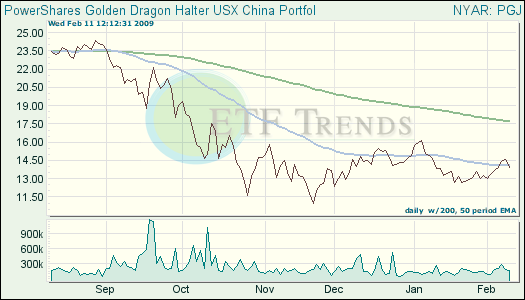

- PowerShares Golden Dragon Halter USX China (PGJ): up 3% for the last three months; up 4.6% for the week.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.