Dismal economic reports are pouring out of Japan and the country is fearful about the possibility of a prolonged stagnation of the economy and subsequent exchange traded funds (ETFs).

Recently, Japan’s government announced unemployment grew from 3.9 to 4.4 percent, a surprise for a country that formerly enjoyed near full employment, reports Frank Ahrens for The Washington Post. After reports from leading industries, it is likely that further employment cuts are on the way as global consumption plummets.

In November, factory production dropped 9.6%, the largest fall since statistics were tracked starting from 1953. Nations that are in recessions are no longer buying up the nifty TVs, audio equipment, chips, etc. that Japan is known for. Japan is the world’s second-largest exporter. Panasonic plans to cut 5% of its workforce, half in Japan and half overseas.

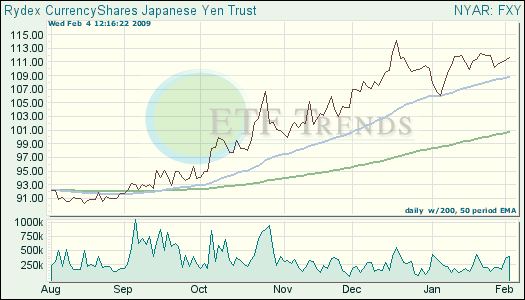

The Japanese yen remains strong but this means prices for its overseas products are increasing, which consequently reduces demand.

Japanese bank strategists see no sign of hitting rock bottom and admitted that recovery may be quite elusive, but Japan has already taken steps to mitigate the situation.

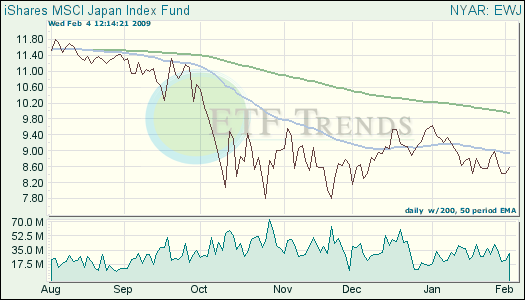

- iShares MSCI Japan Index (EWJ): down 2.6% in the last week; down 10.8% in the last month

- CurrencyShares Japanese Yen Trust (FXY): down 0.2% in the last week; up 3.6% in the last month

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.