You are viewing an older ETF Trends article from 2009. You may be interested in reading our more current articles on Asia and Global ETFs.

Japan has taken steps toward aiding small and mid-size companies in their country, as lowered demand has made it harder for the businesses to keep afloat, and this could impact related markets and exchange traded funds(ETFs).

Cash Injection. As of Tuesday, the Japanese government has outlined a plan that will inject state money into failing companies for an exchange of equity stakes, similar to what has taken place in both Europe and the United States. The announcement by the Trade Ministry is the most recent in a series of efforts taken by the government, reports Bettina Wassenger for The New York Times. Taking these stakes is seen as preferable to waiting for banks to increase lending, something they’ve been skittish about.

Fast Reaction. Over the past few weeks there has been a wave of profit warnings and job losses that have become common during this recession. Recent statistics showed bankruptcies in Japan jumped 24% in December from a year earlier and 33 firms that were listed were struck last year.

The Associated Press reports that Japan’s stimulus budget is aimed at helping the economy, totaling $54 billion. The plan also includes handouts to taxpayers totaling $22.4 billion. The government will now focus on passing a record $984 billion budget for the next fiscal year, which starts April 1.

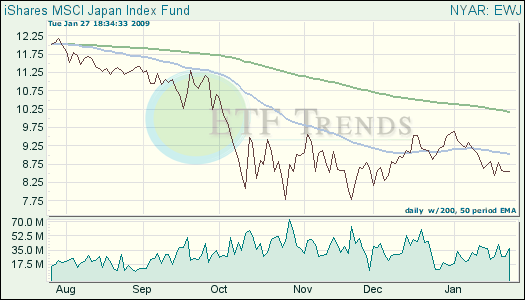

- iShares MSCI Japan Index (EWJ): up 4.6% in the last week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.