Are exchange traded fund (ETF) investors still interested in gold, silver and platinum? Has volatility tamped down demand?

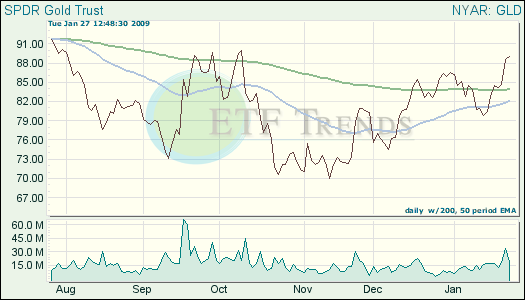

Slipping Prices. Gold has slipped under the $900 per ounce mark, giving up some gains, and easing risk aversion. The recent questions surrounding the financial systems in the United States has help lift gold up to new highs, spurring more safe-haven investors to invest in the precious metal.

Jan Harvey for Reuters reports that gold usually moves in the opposite direction of the U.S. dollar, but their usual relationship has weakened and both assets dipped lower. And while investors are seeking it out for security, demand for the metal as adornment is weak. The main centers of the jewelry industry – India, Turkey and the Middle East – continue to show signs of weakness.

- SPDR Gold Shares (GLD): up 23.2% over past three months

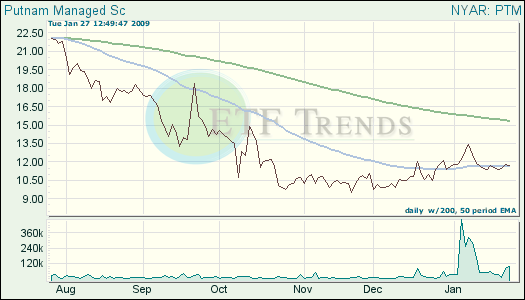

Miners In Trouble. Platinum miners in South Africa are planning to cut back on production, as the global slowdown has left the companies “hemorrhaging cash.” Platinum has dropped 58% since March, causing many mining companies to scale back on expenses, beginning with job cuts. Carli Lourens for Bloomberg reports that the outlook for platinum, and the miners, are dim.

South African-focused Aquarius Platinum Ltd expects a first-half, after-tax loss of $75 million to $85 million due to weak metals prices. The December loss includes a write-down of $20 million, due to the temporary closure of its Everest mine in South Africa, reports Eric Onstad for Reuters.

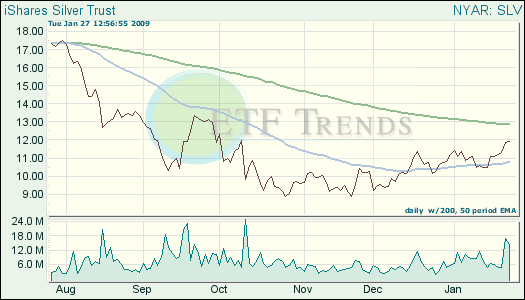

Portfolio Staples. According to a Reuters poll, gold will remain as an investor portfolio staple, but prices of industrial precious metals, including platinum, palladium and silver, are expected to drop further as recession and tumbling consumer and corporate confidence hits demand. Platinum sales are off sharply over falling demand from carmakers, who account for half of global consumption.

Jan Harvey for Reuters reports that gold is expected to climb in 2009, with prices at an average of $800 an ounce. The financial turmoil should keep the gold demand strong. The survey of 56 precious metals analysts and traders was carried out over the last three weeks. It showed gold prices would average $862.50 an ounce this year.

- E-TRACS UBS Long Platinum ETN (PTM): up 18.3% over past thee months

Safe Haven Appeal. Silver prices have also declined, sinking to $12.04 an ounce. Most analysts revealed in a Reuters survey that they expect prices to fare better than those of platinum and palladium, however, as silver has more safe haven appeal.

- iShares Silver Trust (SLV): up 11.8% in the last three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.