At least one exchange traded fund (ETF) is making turning our economy’s lemons into lemonade.

Surprise. Investors are nervous, the markets are lower and earnings season is expected to be anything but celebratory. But the U.S. dollar is surging. The trade deficit improved to a $40.4 billion shortfall, compared with analysts’ estimates of a $51 billion shortfall, reports Riva Froymovich for The Wall Street Journal.

What Gives? A weakened dollar is often thought to be a prerequisite for a shrinking trade deficit. But the dollar was strong at the end of 2008, so oil prices and declining imports have been cited as the reason for the improvement.

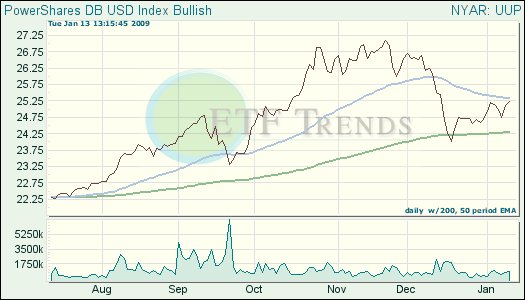

PowerShares DB U.S. Dollar Index Bullish (UUP) is up 2.2% in the last two weeks. Note that it’s above its 50-day moving average, and is close to the 200-day.

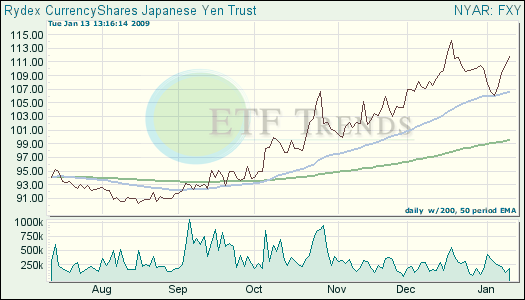

That Isn’t All. The Japanese yen is surging ahead today as risk-averse investors turn to higher-yielding currencies. The yen is considered a safe-haven in uncertain times, says RTT News, and the carry trade has been unwinding.

What Does That Mean? In a carry trade scenario, investors borrow money from Japan, where the interest rate is low, to buy higher-yielding assets in other countries. Unwinding the carry trade means investors liquidate their investments and going after yen to repay the loans. This, in turn, pushes up the currency’s value.

The CurrencyShares Japanese Yen Trust (FXY) is up 1.6% in the last two weeks.

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.