There are many more job losses ahead of the United States, as unemployment has hit 7.2% and December brought total job losses to 2.6 million for the year 2008, taking the luster out of related exchange traded funds (ETFs).

The economy in the United States is quickly dissolving as the unemployment rate is at 7.2%, and the recession is still quite young compared to those in 1974-75 and 1981-82. Around 11 million workers are out of a job and no rank is spared, as hourly workers and management, along with full-time and permanent positions are being eliminated, reports Louis Uchitelle for The New York Times.

The numbers have the job losses at half a million per month, illustrating a U.S. economy that is taking a freefall. On Wall Street, the markets fell on the report, with all three major exchanges down more than 1%.

Businesses have responded to this slowdown by slashing inventories for the third month in a row, reports Martin Crutsinger for the Associated Press. Sales are way down, and as a result, inventories are down by 0.6%, taking a toll on the wholesale picture. Many economists do not expect a recovery until the second half of this year, so sales are expected to weaken even further. Retailers have just come out of one of the worst holiday sales periods on record.

The string of inventory declines reflected the struggle businesses are having trying to keep stockpiles in line with plunging sales. The 7.1% drop in sales in November 2008 is a record number.

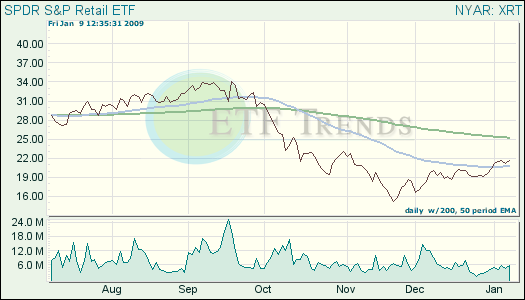

- SPDR S&P Retail (XRT): up 12% for past month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.