A major exchange traded fund (ETF) player in Europe is planning a British Invasion of its own in the United States.

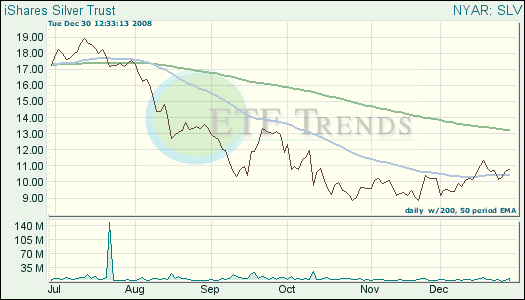

ETF Securities will enter the U.S. market with a silver ETF, as noted in a filing on Dec. 19. The fund will hold silver bullion as its sole asset, similar to the other silver ETF here, iShares Silver Trust (SLV). SLV has garnered a lot of interest, holding $2.2 billion in assets.

The London-based provider, which deals in exchange traded commodities (ETCs) started two years ago with $60 million in assets. After the first year, the number of assets had grown to $2.5 billion. Today, they’re at $6.5 billion and are Europe’s largest ETF provider.

The provider has a line of commodity funds covering everything from the broad market, livestock and agriculture to energy and precious and industrial metals.

ETF Securities Director Hector McNeil noted earlier this year that U.S. investors have expressed a high level of interest in their funds – two-fifths of the inquiries the company receives comes from the United States.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.