The broken-down auto bailout plan in the United States has caused oil prices and the exchange traded funds (ETFs) that track them to drop to indicative numbers.

The $14 billion plan fell through in the Senate and in response, oil fell under $45 per barrel, causing a need for OPEC to step in, reports Pablo Gorondi for the Associated Press. Light, sweet crude for January delivery was down $3.42 to $44.56 a barrel in electronic trading on the New York Mercantile Exchange, to settle overnight at $47.98.

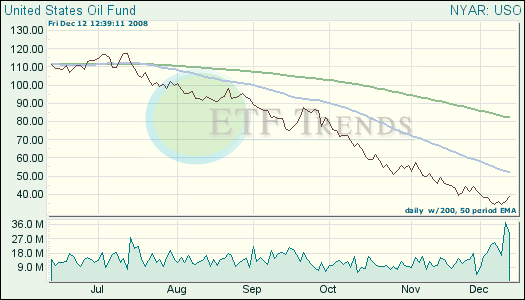

This decline came after yesterday’s gains of 12%, however, this recent decline wiped out much of the gains made the previous day. Any anticipation of oil prices rising back up are unlikely, as the drop in demand for oil in the United States is expected to slow in 2009.

But as demand continues to slow into next year, the year-over-year changes wwon’t be as evident, reports Matthew Robinson for Reuters. This year’s demand drop really gathered steam as oil shot to a record high in July. It’s noted that while demand isn’t expected to grow, it’s also not expected to continue to fall as it has this year.

- United States Oil (USO): down 49% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.