Exchange traded funds (ETFs) are backing off a bit from two-year highs as the U.S. dollar gains against the euro and other major currencies.

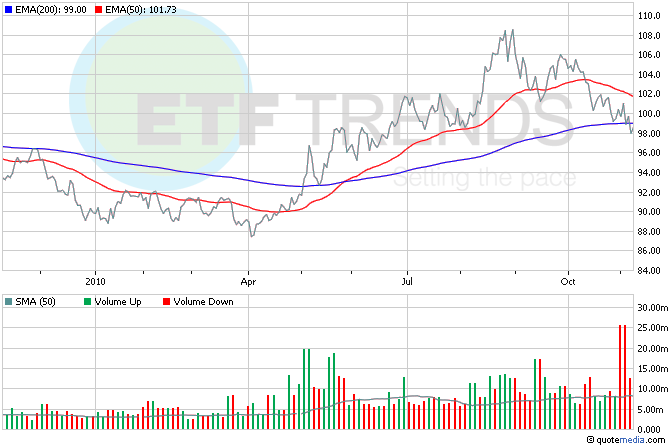

There are no economic reports scheduled to start the week, and traders appear to be viewing signs of strength in the greenback as a reason for cashing in some profits from equities, which are trading at levels not hit since Lehman Brothers went belly up in September 2008. Most analysts expect any rise in the dollar to be a temporary gain, as the price will be constrained by the Federal Reserve QE2 stimulus program which will flood the market with dollars. PowerShares DB U.S. Dollar Bullish (NYSEArca: UUP) is up nearly 1% in early trading. [Federal Reserve’s Plan Turns Commodity ETFs Hot.]

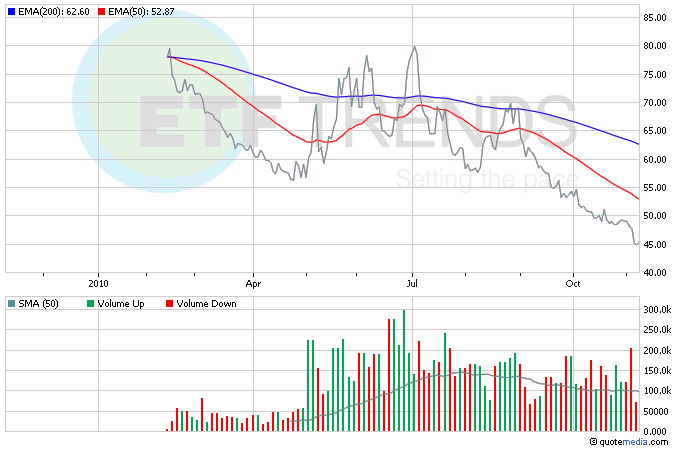

The S&P has been up nine of the past 10 weeks, gaining 17.9%. The fact is that the market got the election results it wanted, the quantitative easing it was expecting, and third-quarter economic reports have been overwhelmingly positive. One sign of turbulence ahead is the friction that has been building as a result of the feds QE2. Officials from several major economies, including Germany’s finance minister, have criticized the Fed’s move to purchase a further $600 billion of longer-term Treasury securities — the centerpiece of QE2. iShares Barclays 20-Year Treasury Bond (NYSEArca: TLT) is up 0.8% so far this morning. [Risk Easing in Corporate Bond ETFs.]

In corporate news, shares of Berkshire Hathaway Inc. (NYSE: BRK-A) are headed down in early trading after the Warren Buffett firm reported late Friday a decline in third-quarter net income. Operating earnings, however, rose to $2.79 billion from $2.06 billion. Chrysler (NYSE: DAI) announced that it will raise its full-year profit forecast despite losing $84 million in the third quarter. That loss was smaller than the $172 million the company lost in the second quarter. ProShares UltraPro Short Dow30 ETF (NYSEArca: SDOW) is up 1.6% so far this morning.

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.