We’re not talking about the way it was, it’s more like the way things will never be again, when speaking about oil and exchange traded funds (ETFs) that track it. Many are saying that we’re in new world of oil reality.

This month, Valero Energy got the bad news that Mexico would be cutting off supplies to one of the company’s Gulf Coast refineries by 15%. Mexico’s oil enterprise is one of the conglomerate’s main sources of crude, reports Steven Mufson for The Washington Post. Mexican sales of crude to the United States is at its lowest level in more than 12 years.

India’s Tata Motors was making its own announcements, with plans to produce a people’s car called the Nano for $2,500 this fall. The idea is to make cars so affordable for people in India and elsewhere, they may sell 1 million per year.

Together, this news is a force pushing the supply and demand of oil to new levels, and taking the price up with it. This oil news is unique, however, because many think that drivers will never see gas prices as low as they once were, causing the Sunday drive of yesteryear to stay there.

Oil and gas have spiked higher in price before. But this latest run-up, experts say, is different. That’s because it’s been accelerating over a period of several years, and ample supplies of crude have proven elusive in that time.

The average price of a barrel of crude oil has doubled from 2001 to 2005, and then doubled again by March of 2008, and then went up 40% again. Cheap oil has become one of the major building blocks of the American economy and society as we know it. Consider the interstate highways, big cars, big planes and commuters living in suburbs-it’s a way of life we may have to begin to reconsider before long, if we haven’t already.

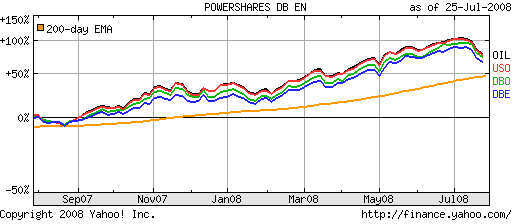

ETFs that could remain affected:

- PowerShares DB Energy Fund (DBE), up 35.3% year-to-date

- United States Oil Fund (USO), up 31.2% year-to-date

- PowerShares DB Oil Fund (DBO), up 34.9% year-to-date

- iPath S&P GSCI Crude Oil Total Return Index Index (OIL), up 30.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.