By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

As we have been discussing for months, from a strictly economic and financial markets perspective, history suggests that the party in the White House has little impact on broad long-term investment outcomes. However, an administration can have significant impacts on individual industries through regulatory change and other tools. The current administration appears different from others in their willingness to speak directly to certain industries and companies in unconventional ways. Off the cuff comments have seemingly harmed certain stocks for short periods of time, though their stock prices have bounced back in short order.

More broadly, this administration has talked down the value of the U.S. dollar, suggesting an end to the “strong dollar” policy that harkens back to the Clinton administration. Here too we think the long-term effects will be limited. While some countries actively manipulate their currency, the value of the U.S. dollar is driven by a complex array of market forces, which should overwhelm political commentary.

In our open system, markets overpower rhetoric. Global demand for U.S. dollars and central bank policy have real implications for the value of the U.S. dollar relative to other currencies. As far as we can see, stricter bank capital requirements and disparate central bank policies should keep demand for the greenback at high levels, which supports the value of the U.S. dollar.

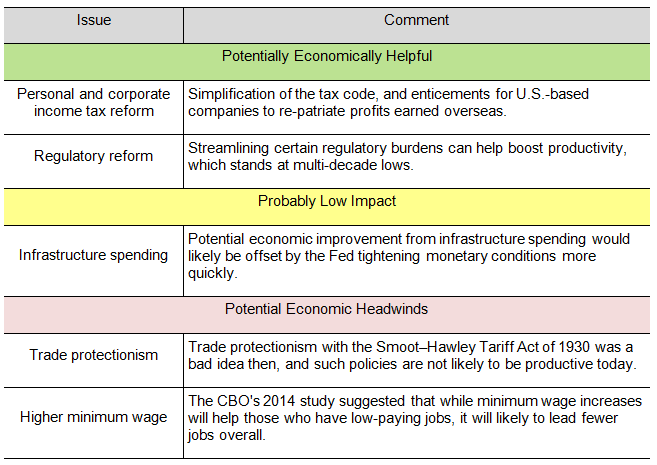

Still, we can look at the President’s stated policies and objectives to get a sense for where things may be headed. While there are many sides to consider with each potential policy and its implications, the following table summarizes our thoughts on the economics of several proposals.

Meanwhile, fundamentals continue to improve. The “Goldilocks” January employment report released on February 3rd showed 227k jobs created versus 175k expected. At the same time, wage pressure is not so strong that the U.S. Federal Reserve (the Fed) should feel threatened by inflation at this point. With the Fed still on hold and economic fundamentals improving, our economy can continue to grow with markets rewarding risk assets like equities.

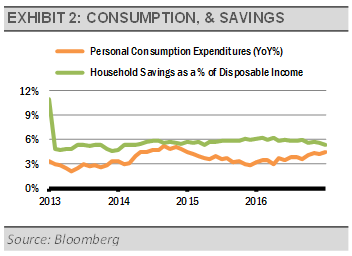

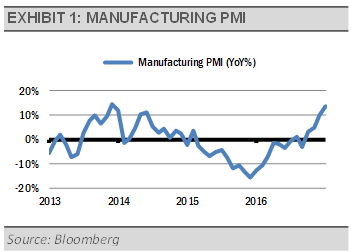

The U.S. economy is showing broad signs of acceleration in 2017, including increases in manufacturing PMI and consumer spending, as confident households have decreased their savings rates to a still healthy level while increasing spending.

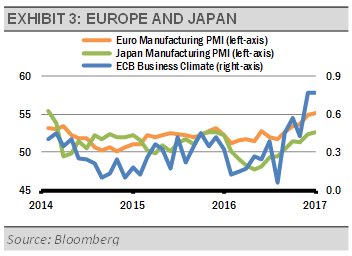

Furthermore, growth in the U.S. can help pull global growth higher through increased trade. This should build on the strength that we are already seeing in data from Europe and Japan. For example, euro zone business confidence is at multi-year high, despite potential political risks coming from the pending election in France. Meanwhile, European and Japanese manufacturing PMIs are higher than they have been in several years.