Note: This article appears on the ETFtrends.com Strategist Channel

By Gary Stringer, Kim Escue and Chad Keller

Stringer Asset Management is risk-aware when looking at the fixed income market due to the asymmetrical returns associated with the asset class. The risk of loss from the asset class can be larger than the potential upside. Therefore, we place an emphasis on the relative risk we are taking on to achieve excess returns, rather than focus solely on the excess return over the risk-free rate.

Some fixed income risk factors are fairly straight forward. For example, interest rate risk as measured by duration is relatively easy to value. In the absence of options (e.g. calls, puts, sinking funds), the longer the maturity of a bond, the longer the duration. In a normal environment investors receive a premium over the risk-free rate as they move out the yield curve and take on more uncertainty with respect to inflation and other factors.

As market conditions change, we experience different movements across the yield curve and generally we can quantify how these yield curve shifts will impact our most basic Treasury holdings. As we layer on additional risk factors, such as credit risk and options, we can estimate a value for them based on historical spreads and performance to determine if we are getting paid fairly for assuming those risks.

Related: Risk First – Why The Global Economy Should Continue to Grow

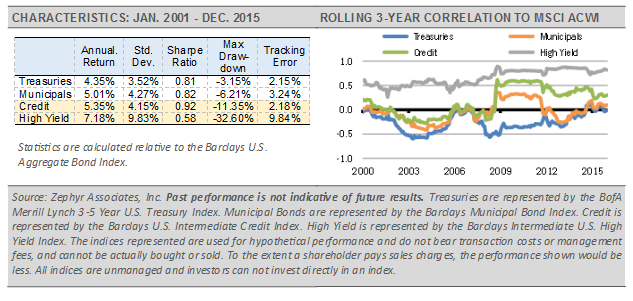

The starting point for our modeling is the Treasury market and, in particular, the 3-Month Treasury Bill. In a normal environment with a positively sloped yield curve, an investor receives an incrementally higher premium for the longer the maturity of a bond. Longer bonds normally have a higher premium because they are impacted to a greater degree by inflation risk and supply and demand, which can cause rates to move. Also, longer duration bonds experience deeper price declines when rates rise. Therefore, we emphasize short to intermediate bonds as they tend to provide a more consistent premium on a risk-adjusted basis when considering standard deviation and downside risk (the following charts compare the Sharpe Ratio, a measure of risk-adjusted returns, and other risk measures for different maturity U.S. Treasury bonds). On average, we think the intermediate are of the curve offers the best risk-adjusted value.

Additionally, we favor investment-grade credit in our strategic fixed income allocations, which exposes a portfolio to corporate risks, such as credit rating changes. Taking on investment-grade credit risk provides a yield advantage and the potential for upside with still enough rate sensitivity to help offset equity risk.

We tend to first favor investment-grade bonds over high yield as strategic holdings. High yield bonds are more likely to be impacted by actual defaults, higher liquidity premiums, and tend to be more equity sensitive (see the correlation to the global equity MSCI ACWI Index graph). Our philosophy with respect to a core fixed income allocation is that the holdings should help mitigate equity risk, so taking on additional equity sensitivity in the fixed income allocation makes little sense.

In addition to interest rate risk and credit risk, we implement a long-term allocation to mortgage-backed securities. These bonds tend to compensate investors for the call option risk they include. Option risks include the prepayment of principal by homeowners due to unplanned events, such as a mortgages being paid off early or the sale of a home. Investors are also compensated for extension risk as interest rates rise and the pre-payment option becomes less attractive, resulting in an extending duration. In general, bonds structured with call options protect better to the downside due to the price compression they experience when interest rates fall. Over time, they tend to provide attractive risk-adjusted results in our opinion.