In the 19th century, Scottish philosopher Thomas Carlyle coined economics “the dismal science”. Since then, this phrase has become a favorite of both economists and non-economists alike. Although the context behind the phrase has changed since it was first used, its current connotation is a comparison between economics and more mechanistic sciences such as physics. A physicist can model the world and, given a set of circumstances, return the outcome with a high level of certainty; in economics, not so much. While economists love to analyze troves of economic data and create complex models, their attempts to predict outcomes in the financial world are rarely correct:

“Economics is a highly sophisticated field of thought that is superb at explaining to policymakers precisely why the choices they made in the past were wrong. About the future, not so much.”

-Former Federal Reserve Chairman Ben Bernanke

This isn’t meant as a knock on economists; predicting the future in economics is incredibly difficult, if not impossible. One way to illustrate this difficulty is with the Butterfly Effect, a part of chaos theory. The Butterfly Effect commonly poses the question: does the flap of a butterfly’s wings in Brazil set off a tornado in Texas? In this context, an economist may be able to look at the tornado and trace the wind patterns back to the butterfly, but to identify a butterfly and determine if, when, and where a tornado will occur is a fruitless endeavor. Therefore, as an investor, it is most likely wiser to put a greater weight on the analysis conducted by economists than on their predictions. One such analysis that we believe is very useful for investors (though we will show doesn’t necessarily require the use of economists) is that of the business cycle.

The Business Cycle

Over long periods of time, economic growth can be attributed largely to increases in population, productivity, and capital. Over the past century, in the United States, these three factors have increased substantially, but growth hasn’t occurred in a straight line. In the short term the economy tends to fluctuate around this long-term growth trend in boom and bust periods known as the business cycle. Although all business cycles will progress differently, there is a fairly uniform progression between four definable stages: early, mid, late and recession. While there are a myriad of economic indicators that correspond with each cycle, we believe that it is easier to explain the cycle as a series of expectations and the optimism or pessimism surrounding them. In a recession people are pessimistic and therefore have low economic expectations, which are easily exceeded. As reality exceeds these expectations, people become more optimistic and gradually increase business activity. The economy then moves through the early and mid stages with optimism and expectations increasing along the way, until it arrives at the late stage where optimism has become so great that the expectations are no longer achievable. With the economy falling short of its expectations, people move from optimism to pessimism, decreasing business activity and ultimately causing a recession.

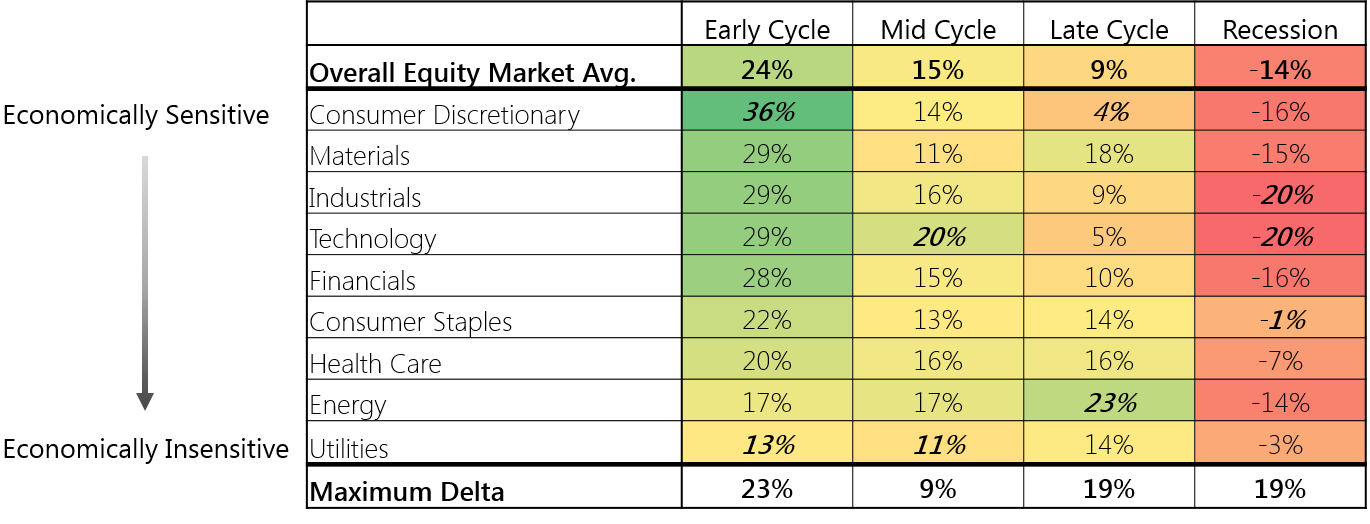

Business cycles are important to investors because different types of businesses behave differently during each phase of the cycle. If a savvy investor can determine which phase of the business cycle an economy currently resides in and when the cycle is shifting, they can opportunistically allocate their assets to sectors that should perform relatively better. In general, this means allocating to businesses providing necessary goods when times are bad and to businesses providing desired goods when times are good. This strategy is often referred to as sector rotation.

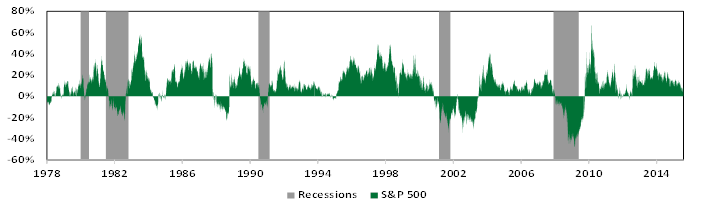

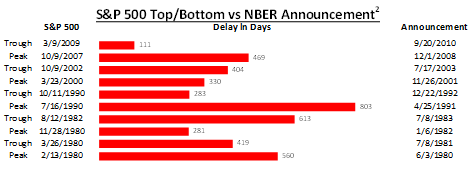

While this sounds wonderful in theory, we must not forgot the plight of our economists. Few would debate that a business cycle exists, but there is often a great deal of debate on what the current phase is and how long it may persist. The most confusing time of all takes place after shifts occur as it can take years to come to a consensus on the matter–far too long to meaningfully improve investment decisions. More importantly, your portfolio’s performance is dependent on the stock market and while it may be correlated to the business cycle, the two rarely move in perfect synchrony. To illustrate this we consulted The National Bureau of Economic Research (NBER), widely considered the final authority on the business cycle, which notes the following five cycles since 1980 accompanied with the official dates of the peaks and troughs. Since we are interested in the investment implications, we will also include the associated highs and lows of the S&P 500® for comparison. As useful as their data may be, the NBER wouldn’t have been very beneficial to any investor looking to capitalize on the business cycle. The market’s top occurred prior to the peak in economic activity in 3 of the past 5 cycles with an average lead time of 110 days; the market’s bottom occurred prior in 4 of the past 5 cycles but with a less astounding lead time of 12 days. Add to this an average delay of just over one year until the official announcement, and you’ll see why this isn’t a great system. To make things even worse for investors, over the same time period there were four occasions (seen below) where the stock market declined even though the economy was not in a recession. Due to this it is often said that “the stock market predicts 9 out of every 5 recessions”.

However, since our investment success ultimately depends on the movements of the market, it may be more accurate to flip this on its head and say, “recessions correspond with 5 out of every 9 market declines”. As a result, it would appear that an investor would be better off listening to the market while keeping the business cycle in mind rather than focusing solely on the business cycle.