Precious metals have gone through large price gains as many investors use the commodities to hedge their portfolio risk and protect against eventual inflation. What other uses do precious metals exchange traded funds (ETFs) serve a portfolio?

Precious metals, especially gold, have drawn investors’ attention over the past few years for several reasons. Mark Salinger for iStock Analyst reports that three major reasons investors use precious metals are:

- One, though the risk of inflation is low now, eventually the money that central banks have put into the financial system will pose a risk of significant future inflation.

- Two, precious metals represent a store of value independent of the financial machinations of balance sheets and earnings projections. That is, gold and silver are worth whatever they’re worth. [Silver and Gold ETF Spotlight.]

- Three, precious metals’ value and acceptance as currency can provide some measure of protection against unstable social and economic environments.

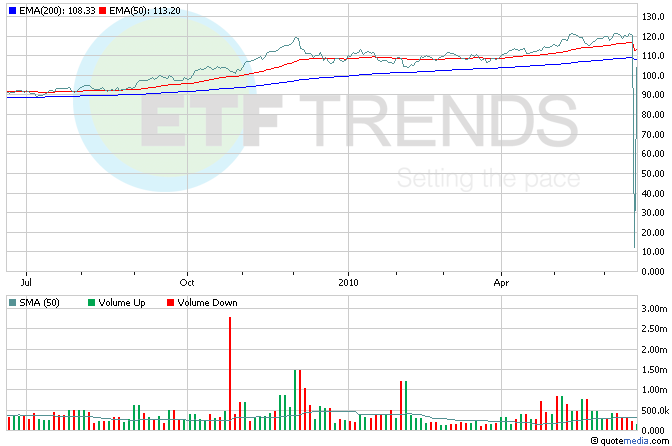

Ron Rowland for Forbes reports that while SPDR Gold Shares (NYSEArca: GLD) is still a winner for assets under management, iShares COMEX Gold Trust (NYSEArca: IAU) is undergoing some changes. IAU is a far cry from the assets under management with GLD, $38 billion worth of gold in storage, while IAU only has about $3.3 billion. BlackRock announced a 10 for 1 share split for IAU. The split will be effective after the close today. [The Case for Investing in Gold ETFs.]

As in stocks, ETF share splits do nothing to directly increase the value of your investment. Instead of owning one $120 share, you will have 10 $12 shares. So why is iShares doing it? The lower price may enhance liquidity, since smaller players will be able to take advantage of the creation/redemption mechanism.

Large investors who typically pay trading commissions at a per-share rate will actually be encouraged to abandon IAU for GLD – which will still have a share price in the $120 range. Will this move prove lucrative for IAU? All we can do is wait and see.

For more stories about gold, visit our gold category.

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.