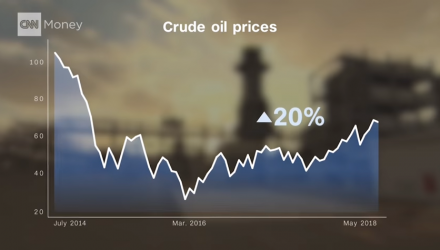

There are a number of Oil ETFs that have been making strong moves in the backdrop of the crude oil rise.

According to Wall St.’s BEST Daily, “Oil ETFs are starting to look appealing again after dipping in February and March. Oil prices are now back above their 50-day moving average ($63). Unless they drop back below that average, oil is a good momentum play; and the most efficient way to play it is through an oil ETF.”

ETFS to Consider as Momentum Rises

The oil markets are improving and the energy sector has strengthened on stabilized prices, with oil refiners and sector-related ETFs taking the lead. The VanEck Vectors Oil Refiners ETF (NYSEArca: CRAK), the only exchange traded fund dedicated to oil refiners, increased 5.21% year-to-date.

“I do think it is certainly worth pointing out the strong performance of the industry as a whole,” Brandon Rakszawski, Product Manager for VanEck, told ETF Trends.

The United States Oil Fund (NYSEArca: USO), which tracks West Texas Intermediate crude oil futures is up 14.9% year-to-date and the United States Brent Oil Fund (NYSEArca: BNO), which tracks Brent crude oil futures is up 14.64%.

For more information on the oil market, visit our oil category.