As 2019 fast approaches, the ETF industry is thriving with net year-to-date inflows of $304 billion in the U.S. with no sign of slowing down.

U.S. ETF total assets currently sit at $3.397 trillion with the average daily trade volume increasing by 46.4% to $99.53 billion as compared to the same period last year, according to XTF data.

In order to launch a successful ETF, an issuer must craft a unique offering that has a specific investment objective, strong internal structure and a compelling marketing message just to have a chance of competing. It’s also imperative that the ETF trades freely and effectively with as much initial exposure as possible as a slow start can hinder the future growth of any ETF launch.

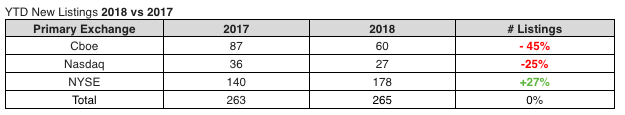

With that in mind, more ETF issuers are making The New York Stock Exchange the exchange of choice for ETF listings. In 2018, NYSE launched 178 new ETFs, a 27 percent increase from its 140 new ETFs launched in 2017. Compared to the other U.S. exchanges, Nasdaq launched 27 ETFs in 2018, a 25 percent decrease from its 36 launches in 2018. Meanwhile, Cboe launched 60 ETFs in 2018, a 45% decrease from its 87 ETFs launched in 2017.

Source: NYSE

Douglas Yones, Head of Exchange Traded Products at NYSE, said NYSE Arca has long-held the industry mantle as “The Home of Exchange Traded Funds.”

Doug Yones

“This year the NYSE launched 178 new ETFs, about three times more than our nearest competitor,” Yones said. “NYSE currently has 1,574 listed ETFs, representing 71 percent of total US listings market share.”

Asked why NYSE is experiencing continued success, Yones responded: “Ultimately, while our peers stand still, we keep moving.”

“We are always on the lookout for ways we can drive enhancements to U.S equities market structure, streamline the listings experience for issuers via new generic listing standards, and developing truly innovative enhancements for the ETF industry such as the NYSE Arca’s new official closing price,” Yones said.