The ongoing bull market has kept many focused on risk assets, but don’t forget about the potential benefits of diversifying a traditional stock and bond portfolio with alternative assets like gold exchange traded funds.

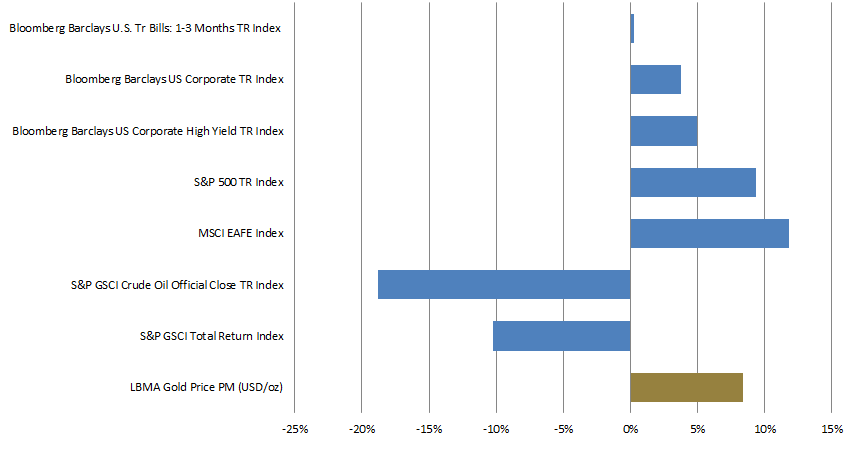

On the recent webcast (available on-demand for CE Credit), Gold Investing Outlook Continues to Shine, Juan Carlos Artigas, Director of Research for World Gold Council, noted that despite its recent pullback, gold has done relatively well so far this year, outpacing fixed-income assets and the broader commodity indices, especially with the ongoing pressure in the energy market.

“Behind gold’s performance, there’s been a combination of factors, including a weaker dollar; market uncertainty despite the observed low volatility environment; strong investment demand, especially in Europe; and a recovery in Asian demand from the weaker levels seen last year,” Artigas said. “However, the gold price also faced some headwinds as interest rates in developed markets have generally moved higher and inflation, seen as driver of gold by investors, has yet to pick up.”

While inflows and investment interest in gold have not been as high as they were last year, gold continues to plod along this year on increased demand for a volatility hedge. George Milling–Stanley, Head of Gold Strategy at State Street Global Advisors, pointed out that investors bought an additional $1.3 billion in shares or equivalent to 37 tonnes of gold during the first half of the year. Investors interested in gaining exposure to gold price moves have turned to the popular SPDR Gold Shares (NYSEArca: GLD) as an easy way to access the gold market.

“What investors are telling me is that they are continuing to use gold to counterbalance their increased exposure to stocks and other riskier assets. And the data supports this,” Milling–Stanley said.

Looking around the world, gold demand has been particularly strong out of Europe this year, notably from Germany, the United Kingdom and Switzerland. Artigas pointed out that European gold-backed ETFs attracted 130 tonnes or around 70% of this year’s inflows. This may be attributed to the increased political risks around general elections and Brexit talks, which may have safe-haven demand.