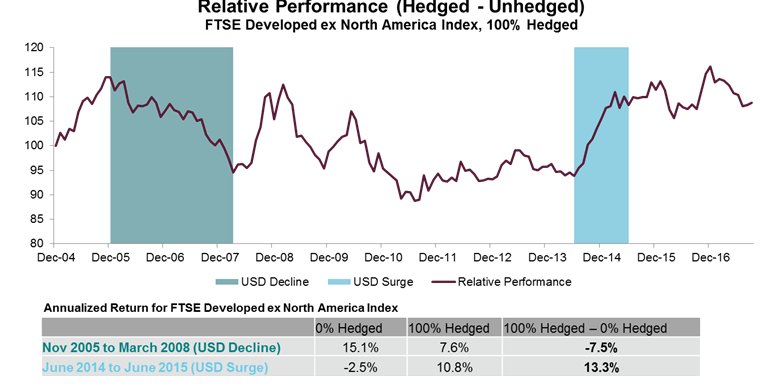

“Currency is not viewed as an economic asset and theoretically should have no long-term expected return,” Yan said. “However, in the short or medium-term, currency can have significant return impact.”

Yan argued that currency risk is a major contributor to volatility in foreign equity exposure. From the period ended 2004 through September 2017, the annualized volatility for a 0% unhedged FTSE developed ex North America Index was 17.20%, compared to a volatility of 13.83% for a 100% hedged index. This shows that investors who want long-term exposure to foreign equities may diminish portfolio volatility by simply hedging their currency risk.

However, there are periods in between when the dollar weakness and an unhedged position may benefit from stronger foreign currency exposure.

“Uncertainty in return or risk reduction, together with time varying correlations makes hedging a challenging decision,” Yan said.

Investors who are interested in foreign equity exposure may then consider a 50% hedged and 50% unhedged international portfolio to take on a more neutral market position that captures foreign equity returns while somewhat diminishing portfolio volatility associated with currency risks to produce improved risk-adjusted returns over time. A 50% hedge embodies no currency forecast in a neutral position, minimizes investor regret, cuts down hedging costs and historically exhibited non-linearity in volatility reduction, Yan said.

ETF investors interested in foreign market exposure and in taking a more neutral view on foreign currency movements can consider a handful of 50% hedged/50% unhedged options, including the IQ 50 Percent Hedged FTSE International ETF (NYSEArca: HFXI), IQ 50 Percent Hedged FTSE Europe ETF (NYSEArca: HFXE) and IQ 50 Percent Hedged FTSE Japan ETF (NYS Arca: HFXJ). All three funds have approximately half their currency exposure of the securities in the underlying index hedged against the U.S. dollar on a monthly basis.

Financial advisors who are interested in learning more about currency-hedged international strategies can watch the webcast here on demand.