As the economy improves and the investing outlook changes, market participants should consider ways to diversify their portfolios in case of sudden turns. Investors may consider alternative investments like commodity exchange traded funds that may help capture opportunities ahead and cushion against slips in traditional assets.

On the recent webcast (available On Demand for CE Credit), What You Should Know About Commodities Now, William Rhind, Founder and CEO of GraniteShares ETFs, argued that investors should consider commodities due to the current rebalancing supply and demand dynamics, rising inflation outlook and portfolio diversification benefits.

The current supply and demand appear favorable for a rally in prices after the multi-year weakness in the broad commodities market.

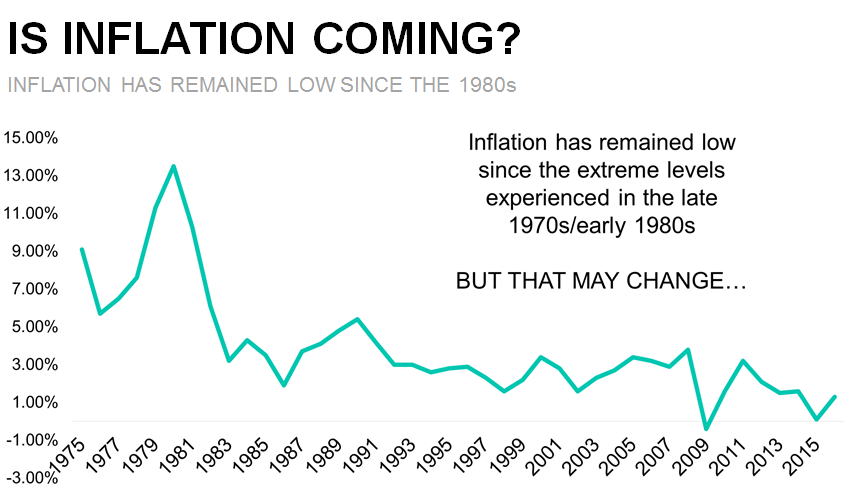

Headline inflation has also remained depressed for a prolonged period, with inflation hovering near a low range since the late 1970s. Looking ahead, experts project inflation will break 2% in 2018 from their current levels due to a number factors like changing geopolitical and monetary factors, higher prices for domestic goods in a more protectionist environment, stabilizing oil prices that would mitigate expectations for lower inflation and a close to fully employed U.S. economy.

Nevertheless, there may be unexpected turns that could cause inflation to spike beyond what many anticipate, and many have grown complacent in a low inflation environment.

“Being that commodities are at relatively cheap compared to historical values, it may make sense to hedge your portfolio of these risks beforehand, not afterwards,” Aaron Gilman, Chief Investment Officer of Independent Financial Partners (IFP), said, adding that commodity futures typically outperformed during periods of unexpected inflationary risks.