In addition, most volatility ETPs are passively managed. This is tricky when volatility conditions change extremely fast. Anyone who has kept an eye on daily movements in the VIX or related ETPs knows that double-digit daily moves are not uncommon. Yet many volatility ETPs are methodically managed in a passive fashion and are not designed to react to changing market conditions.

Finally, the very fact that the prices of volatility ETPs are so volatile themselves makes them inappropriate as a long-term investment vehicle and impractical as a hedging vehicle. As discussed in a previous blog post, variance drain deteriorates the long-term value of any investment.

Generally speaking, the more volatile an asset and the longer the holding period, the more variance drain will diminish its value. Since volatility ETPs are so volatile, the impact of variance drain is especially pronounced.

Role in a Portfolio

If one intends to use volatility ETPs to profit from volatility, the time horizon must be very short—not much longer than a few days or weeks, in most cases. In other words, volatility ETPs are better suited for speculative purposes. The factors discussed—contango, passive management, and variance drain—make volatility ETPs a poor choice for hedging or long-term investing.

At this point, an astute investor may wonder, “If long volatility strategies have lost so much money so consistently, then why shouldn’t we flip the script? Wouldn’t a short volatility strategy mint money?”

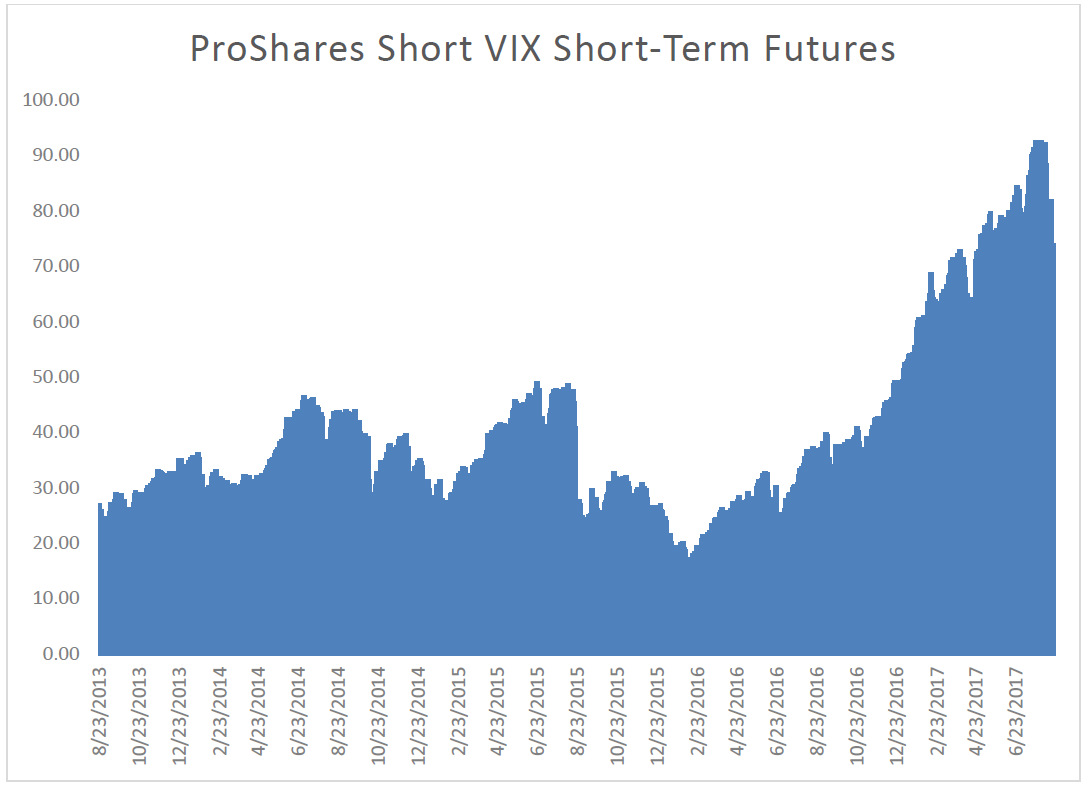

There are short volatility ETPs available, and yes, their performance of late has been eye-popping. The fact that realized volatility has been less than implied volatility is the ideal situation for a short vol strategy. The contango phenomenon works for, not against, a short strategy.

![]() That said, the other concerns regarding volatility plays remain true for short strategies. Short strategies are also very volatile and can lose a lot of money quickly. They are usually passively managed, so losing positions can snowball quickly, wiping out months of gains. Variance drain is very much a concern in a highly volatile product, and the impact of variance drain will be multiplied in a leveraged product. The graph below shows the price movements on the SVXY, a short volatility product.

That said, the other concerns regarding volatility plays remain true for short strategies. Short strategies are also very volatile and can lose a lot of money quickly. They are usually passively managed, so losing positions can snowball quickly, wiping out months of gains. Variance drain is very much a concern in a highly volatile product, and the impact of variance drain will be multiplied in a leveraged product. The graph below shows the price movements on the SVXY, a short volatility product.

Source: Morningstar Direct, Swan Global Investments

During the August 2015 correction, the SVXY lost over half its value in ten trading days. A short while later, the ETF again lost almost half its value between December 1st, 2015 and February 11th, 2016.

VIX ETPs vs. Defined Risk Strategy

If one wishes to potentially harvest the so-called volatility premium over longer time horizons, it is the opinion of Swan Global Investments that you need to do so directly. If you want to seek profit from the fear and volatility that is priced into current options, you typically must trade the options themselves.

Also, given how quickly things change in the options market, it is essential to have active management and strict risk controls in place to mitigate and manage the risk of a volatility capture strategy. This approach to premium harvesting is one of the components of Swan’s Defined Risk Strategy (DRS).

For 20 years the DRS has systematically attempted to collect the volatility premium by selling out of the money calls and puts on the S&P 500. The DRS combines volatility capture, long exposure to the market via ETFs, and hedging techniques in a single strategy seeking to provide consistent returns throughout rising, declining, or flat markets.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.