Investors are picking themselves up in 2019 after a tumultuous way to end the 2018 year. After all was said and done, the Dow Jones Industrial Average fell 3.5 percent, while the S&P 500 was down 4.4 percent and the Nasdaq Composite declined 2.8 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year, including alternative strategies that can provide uncorrelated returns with the movement of U.S. equities.

Capitalizing on Deal Spread

One such area investors may not be familiar with include merger arbitrage strategies.

“Alternative investments, specifically merger arbitrage strategies, are designed to provide some protection in times like these while allowing investors to maintain exposure to the market,” wrote Salvatore Bruno, Chief Investment Officer of IndexIQ.

The impetus for incorporating a merger arbitrage strategy is using event-driven news to capitalize on pricing differences between the current trading price of a recently announced merger or acquisition target and the target price. The target’s stock price is typically impervious to the fluctuations of the market from the time an acquisition deal is announced up to when the actual deal closes.

“For example, ABC company announces its intent to acquire XYZ company for $100 a share,” wrote Bruno. “Prior to the news, XYZ is trading at $90 and subject to typical market activity; post-news, its shares jump to $99, still a dollar short of the offer price. The reason for this spread, or difference in share prices, is the risk of deal failure, or the chance that the deal won’t go through for one reason or another.”

Have you signed up for the ETF Trends Virtual Summit on Wednesday, April 17? It’s complimentary for financial advisors (earn up to 5 CE Credits)! Register now to learn about fixed income strategies for a changing debt world.

“Once the deal is announced, the acquisition target is usually less subject to the movements of the market, potentially creating a smoother source of returns,” Bruno added. “When the deal does close at $100 a share, the arbitrage, or potential gain, is $1 a share.”

Bruno also notes that while arbitrage opportunities exist regardless of the construction of the deal, deals including cash can provide further insulation from market fluctuations, which have become more prevalent in recent years.

Merger Arbitrage Strategy in an ETF Wrapper

In order to take advantage of the deal spread as well as to reduce risk of a merger deal falling through, the strategy invests in multiple deals that are scattered through various phases of the deal cycle. In the past, such a strategy has only been made available for investors of high net worth, but it is now being replicated in an ETF wrapper for all investors via the IQ Merger Arbitrage ETF (NYSEArca: MNA).

In 2018, mergers and acquisitions were abound in various sectors as the historic bull market in U.S. equities saw a serendipitous rise in such activity, particularly from the technology sector that fueled much of the growth. Notable activity came from the likes of tech giants, such as Hewlett-Packard Enterprise, Cisco Systems, Accenture, Cisco Systems, AT&T, and Sprint.

However, mergers and acquisitions have been seen across a variety of sectors, which has helped MNA. MNA seeks investment results that correspond generally to the price and yield performance of its underlying index, the IQ Merger Arbitrage Index, which seeks to employ a systematic investment process designed to identify opportunities in companies whose equity securities trade in developed markets, including the U.S., and which are involved in announced mergers, acquisitions and other buyout-related transactions.

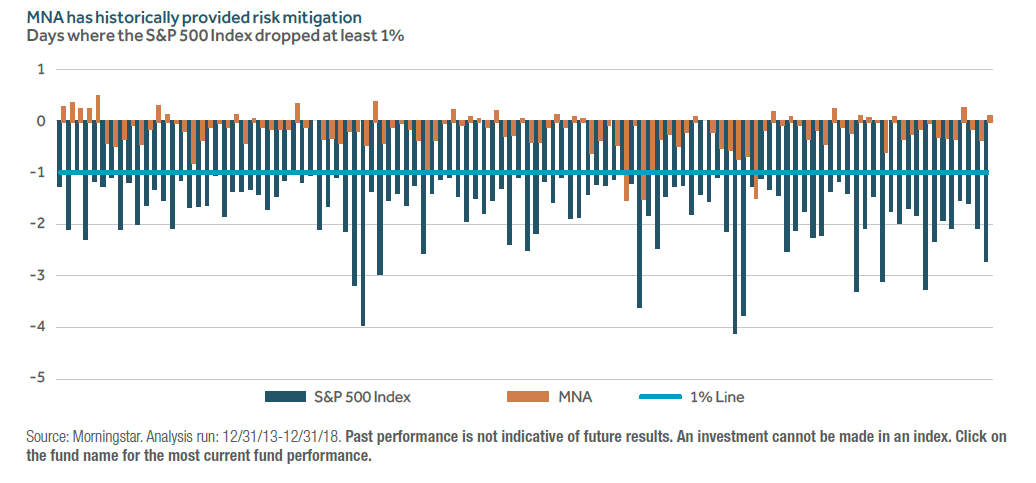

Performance of merger arbitrage strategies historically has been uncorrelated to other core asset classes, providing a potential source for downside risk mitigation. Merger arbitrage returns are tied to the interest rate cycle, as the risk-free rate is an inherent part of the deal spread. Merger arbitrage strategies may also be a potential dampener for stock market volatility; on days when the S&P 500 fell 1% or more in the current economic cycle, M&A strategies did not decline as much and in many cases provided positive returns.

MNA has historically provided risk mitigation

Days where the S&P 500 Index dropped at least 1%

Source: Morningstar. Analysis run: 12/31/13-12/31/18. Pas performance is not indicative of future results. An investment cannot be made in an index. Click on the fund name for the most current fund performance.

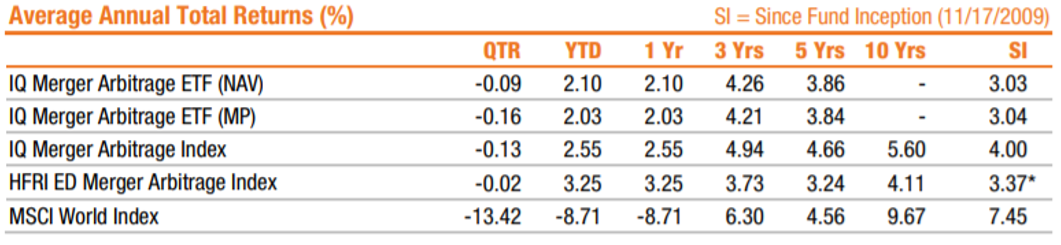

As of 12/31/18

Returns represent past performance which is no guarantee of future results. Current performance may be lower or higher. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Visit nylinvestments.com/etfs for the most recent month-end performance. *Since Inception Performance as of 11/30/2009.

Shares bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 pm ET net asset value (NAV). Beginning on May 31, 2016, the price used to calculate the market price returns (“MP”) is the mean between the day’s last bid and ask prices. Prior to May 31, 2016, market price returns were calculated using the day’s closing price on the fund’s primary exchange. The market price returns do not represent returns an investor would receive if shares were traded at other times.

About Risk

There is no assurance that fund objectives will be met.

Before considering an investment in the Fund, you should understand that you could lose money.

Certain of the proposed takeover transactions in which the Fund invests may be renegotiated, terminated or involve a longer time frame than originally contemplated, which may negatively impact the Fund’s returns. The Fund’s investment strategy may result in high portfolio turnover, which, in turn, may result in increased transaction costs to the Fund and lower total returns. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. These risks may be greater for emerging markets. Diversification does not eliminate the risk of experiencing investment losses. Stock prices of mid and small capitalization companies generally are more volatile than those of larger companies and also more vulnerable than those of larger capitalization companies to adverse economic developments. The Fund is non-diversified and is susceptible to greater losses if a single portfolio investment declines than would a diversified fund.

The ETF should be considered a speculative investment with a high degree of risk, does not represent a complete investment program and is not suitable for all investors. The Fund may experience a portfolio turnover rate of over 100% that will increase transaction costs and may generate short-term capital gains which are taxable.

The IQ Merger Arbitrage Index seeks to achieve capital appreciation by investing in global companies for which there has been a public announcement of a takeover by an acquirer.

The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market.

Consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. The prospectus and the statement of additional information include this and other relevant information about the Fund and are available by visiting nylinvestments.com/etfs or calling 888-474-7725. Read the prospectus carefully before investing.

New York Life Investments is a service mark and name under which New York Life Investment Management LLC does business. New York Life Investments, an indirect subsidiary of New York Life Insurance Company, located at 51 Madison Avenue, New York, New York 10010, provides investment advisory products and services. IndexIQ® is the indirect wholly owned subsidiary of New York Life Investment Management Holdings LLC and serves as the advisor to the IndexIQ ETFs. ALPS Distributors, Inc. (ALPS) is the principal underwriter of the ETFs, and NYLIFE Distributors LLC is a distributor of the ETFs. NYLIFE Distributors LLC is located at 30 Hudson Street, Jersey City, NJ 07302. ALPS Distributors, Inc. is not affiliated with NYLIFE Distributors LLC. NYLIFE Distributors LLC is a Member FINRA/SIPC. 1806517