When looking into exchange traded funds, investors should lift the hood and break down the various costs of ownership.

On the recent webcast (available on demand for CE Credit), Looking Under the Hoods of ETFs, Edward Rosenberg, Head of Exchange Traded Funds at American Century Investments, Sandra Testani, Director of Product Management – Alternatives and ETFs – for American Century Investments, covered the total cost of ownership that goes beyond the sticker price. By looking under the hood, investors can make more informed decisions to better select the investments that best meet their needs.

Taking a cursory glance of an ETF investment, an investor may look at the expense ratio, the daily volume of the fund and the price spread on a brokerage platform. However, this only paints part of the overall picture.

The total cost of ownership covers these explicit costs, as well as implicit and opportunity costs. Specifically, explicit costs include expense ratio, brokerage commission fees and the ETF’s bid-ask spread. Additionally, implicit costs include tax efficiency and tracking errors while opportunity costs cover the ETF’s product design and optimal strategy.

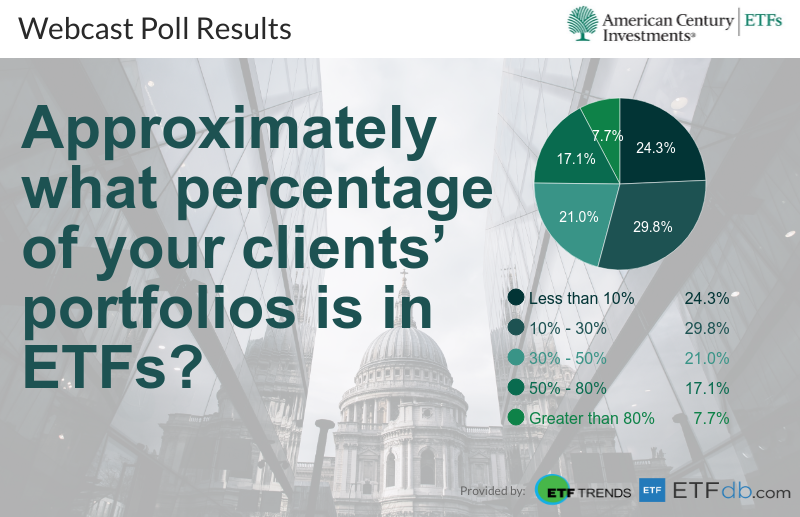

Webcast participants were asked about the percentage of ETFs in client portfolios.

Explicit costs are pretty straight forward as investors can look for an ETF’s trading costs like spreads and commissions, along with expense ratio costs that cover management fees, custody costs and acquired fund fees and expenses.

ETF volume, on the other hand, is only part of the story. On the secondary market, we can see the current bid/offer spread and size available to trade at market, along with the average daily volume. However, ETFs always have more than one level of liquidity. The ETF market depth may be broadened through the non-displayed liquidity or the behind-the-scene levels at which market makers are willing to trade larger orders by tapping into the underlying portfolio. Consequently, an ETF’s true liquidity is better reflected by the liquidity of its underlying holdings as facilitated through the creation and redemption process.

When looking at implicit costs, there are factors that portfolio management decisions can account for, including capital gains, turnover and tracking errors. Meanwhile, distribution fees and realizing a gain are outside an PM’s control.

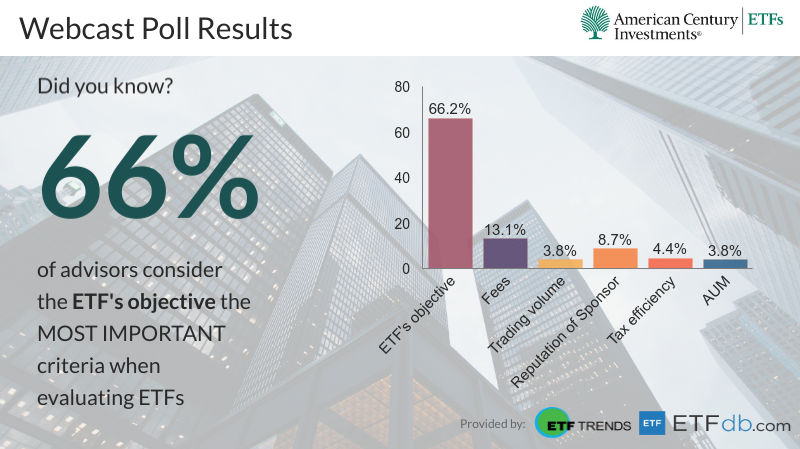

Webcast participants were asked about the most important ETF criteria when evaluating funds.

Lastly, opportunity costs can come in many forms. ETFs that appear the same can behave differently, and how an ETF delivers exposures can affect two different ETFs’ performances over time. For example, investors have to consider how the index is replicated or sampled; sector concentrations; geographic over-concentrations; how it gains its exposure; potential currency exposures with foreign holdings; and how it balances turnover, capital gains and indexing tracking.

With these basic oversights in mind, American Century Investments argued that investors should first look under the hood to more thoroughly assess ETF investments. People should look closely at how a given ETF is delivering the exposure it aims to provide. Even with low trading volumes, most ETFs delivered tight spreads, and these tight spreads help keep costs lower for investors. Additionally, investors should look beyond turnover for a more accurate understanding of capital gains exposure.

At American Century Investments, investors can browse through intelligent beta strategies, such as the American Century STOXX U.S. Quality Value ETF (NYSEArca: VALQ), American Century Quality Diversified International ETF (NYSEArca: QINT) and American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). The ETFs systematize similar attributes that fundamental research seeks to identify, in a rules-based, indexed approach.

Additionally, one can look to actively managed strategies like the American Century Diversified Corporate Bond ETF (NYSEArca: KORP) and American Century Diversified Municipal Bond ETF (NYSEArca: TAXF). The ETFs integrate the insights of American Century’s fundamental investing experts with the research methodologies of their Global Analytics Team.

Financial advisors who are interested in learning more about incorporating ETFs in a diversified investment portfolio can watch the webcast here on demand.