![]() By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

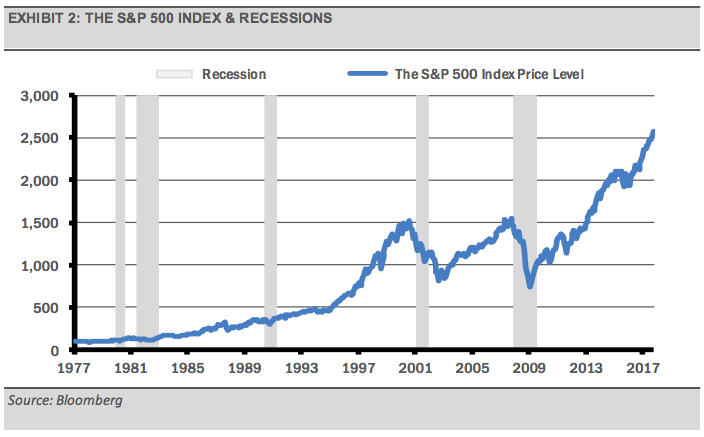

The primary risk to most investors’ portfolios are large stock market declines, and most large stock market declines of 20% or more are associated with recessions. During a recession, corporate revenues and earnings contract, and stock prices generally follow the earnings decline. Therefore, it is very important for investors to understand the causes of a U.S. recession.

While the U.S. Federal Reserve (Fed) has been successful over the long-term in aiding an environment for growth in the U.S., history teaches us how their long-term focus and dual mandate can translate into risks for investors. As their dual mandate dictates, the Fed is charged with controlling inflation and balancing unemployment. Recently, the Fed has begun a tightening cycle, which has implications for market success and investors. Therefore, we continue to believe this tightening cycle and Fed policy is a key risk consideration for equity investors.

FOLLOWING THE FED

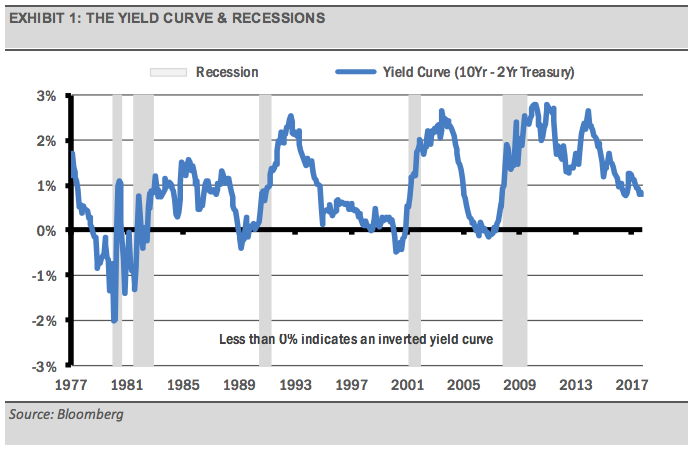

As we have shown in previous work, “The 100 Year Learning Curve: Fed Policy and Recessions,” nearly every recession, and large equity market decline by extension, was caused by a U.S. Federal Reserve (Fed) policy error in our opinion. For example, each recession that has occurred during the last 50 years was preceded by the Fed over-tightening monetary policy and causing the Treasury yield curve (the difference in yield between long-term and short-term bonds) to invert.

Equity prices then suffer subsequent declines on the back of the inversion as noted in exhibit 2.

Judging by that metric, Fed policy is far more influential to the economy than any other program. Importantly, the Fed can tip the economy into a recession without necessarily inverting the yield curve. For example, the last time long-term U.S. interest rates were as low as they are now was in the 1930s. During that period, the U.S. suffered multiple recessions without an inverted yield curve

WHERE DO WE STAND NOW

In general, we think the global economy is in good shape and the current business cycle can continue for years on the condition that the Fed does not make a significant policy error. Up to this point, we have been comfortable with their policy moves since the spring of 2016 when the Fed put further rate hikes on hold until this past December.

Other global central banks, including the European Central Bank and the Bank of Japan, continue to support the global economy through monetary stimulus, such as quantitative easing. This stimulus is warranted since many other regions are lagging the U.S. recovery and their central banks rightly continue to support growth. We think that this additional global stimulus creates more room for the U.S. Federal Reserve to tighten their policy.