Britain’s national soccer team is finding their groove with their entry into the semifinals of the World Cup, but the state of their government paints a paradoxical picture as key members leading Britain’s efforts to cut ties with the European Union resigned on Monday.

Exits by top diplomats like Brexit Secretary David Davis and British Foreign Secretary Boris Johnson made headlines, putting British Prime Minister Theresa May’s leadership in question with key political figureheads like Jeremy Corbyn responding with indignation.

David Davis resigning at such a crucial time shows @Theresa_May has no authority left and is incapable of delivering Brexit.

With her Government in chaos, if she clings on, it’s clear she’s more interested in hanging on for her own sake than serving the people of our country.

— Jeremy Corbyn (@jeremycorbyn) July 8, 2018

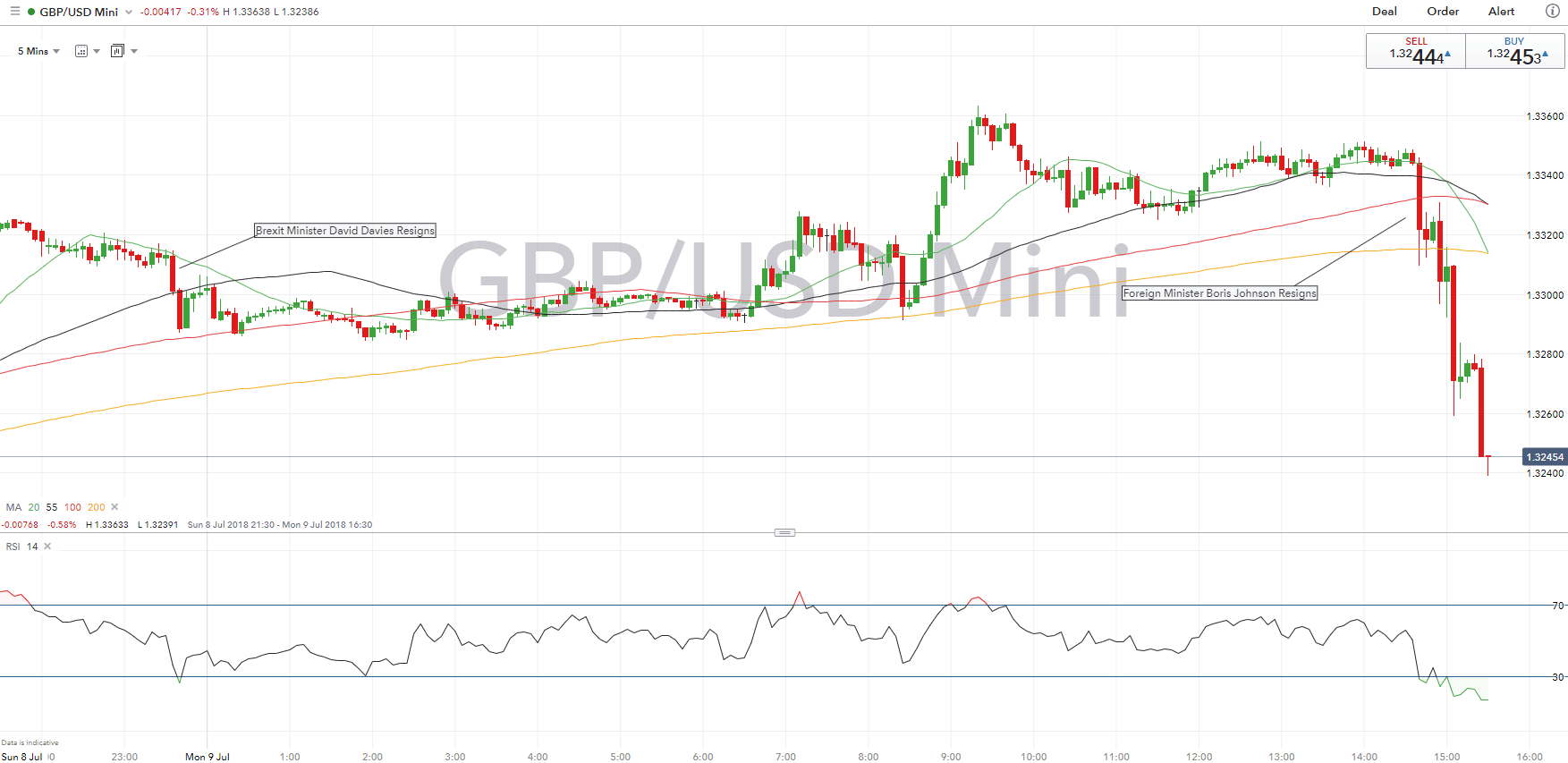

The resignations of Davis and Johnson swing the initial Brexit plans towards a “no deal” that leaves questions as to who may leave next. The markets responded with the British pound dropping sharply against the dollar following the resignation news.

![]()

U.K. ETFs Respond in the Green

According to total assets under management, four out of five of the biggest U.K.-focused ETFs were mostly trading up on Monday–iShares MSCI United Kingdom ETF (NYSEArca: EWU) gained 0.77 percent, Invesco CcyShrs British Pound Stlg (NYSEArca: FXB) was the sole ETF down at 0.02 percent, iShares MSCI United Kingdom Small-Cp ETF (BATS: EWUS) was up 0.37 percent, iShares Currency Hedged MSCI UK ETF (NYSEArca: HEWU) was up 0.17 percent, and SPDR MSCI United Kingdom StratFacts ETF (NYSEArca: QGBR) was up 0.41 percent.

For more trends affecting U.K. ETFs, click here.