If you’re using funds, such as IBB and BBH, for biotech exposure in your portfolio, you’re mostly investing in the industry’s biggest names.

IBB has nearly 30% of its assets invested in the big 4 biotech companies – Gilead, Biogen, Amgen and Celgene.

Equal weighting the biotech sector might be a better way to balance out risk and improve returns.

I propose using a pair of equal-weight biotech ETFs in place of IBB.

This idea was discussed in more depth with members of my private investing community, ETF Focus.

The iShares Nasdaq Biotechnology ETF (IBB) is the largest biotech-focused fund there is. With nearly $10 billion in assets, it is THE proxy for the biotech sector for many investors. But is it the best proxy? IBB does a pretty good job of covering the entire biotech sector.

It’s broadly diversified and covers not only the industry’s giants, such as Gilead (GILD), but also the tiny companies that are still pushing their lead drugs through clinical trials. My only real quibble with the fund is its market-cap weighting strategy. It’s putting a lot of weight into just a few names, and it’s cost shareholders over the last few years.

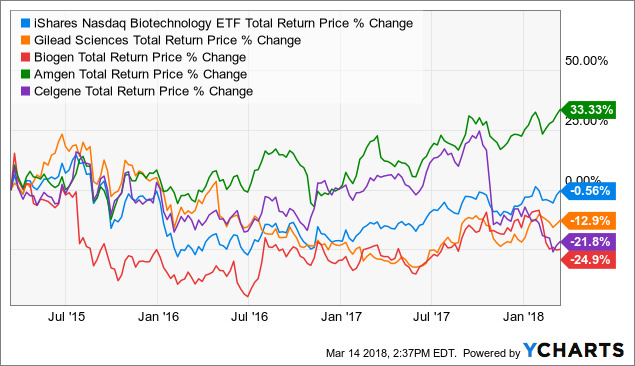

Over the past three years, IBB has returned precisely 0% with some wild swings in returns along the way. The main culprit is the mega-cap biotechs – Gilead (GILD), Biogen (BIIB), Amgen (AMGN) and Celgene (CELG).

![]()

Amgen has done pretty well, but the other three have been real anchors. With those four names alone accounting for around 30% of the fund’s assets, it’s going to be difficult for IBB to make a sustained move up without those names on board.

In the biotech sector, I think equal-weighting is the way to go. In such top heavy sectors, it helps spread out and diversify away some concentration risk, while adding the extra return potential of some of the sector’s smaller names.

The obvious alternative to IBB is the SPDR S&P Biotech ETF (XBI), an equal-weighted fund that holds around 100 names, about 90% of which also appear in IBB, but skews much more heavily to small- and mid-cap names. It’s performed monumentally better than IBB over just about any time period you look at (XBI has returned 27% over the past three years compared to the -1% return of IBB shown in the chart above). I certainly wouldn’t fault anybody for going this route, but there’s another strategy I like too.

The Virtus LifeSci Biotech Products ETF (BBP) and the Virtus LifeSci Biotech Clinical Trials ETF (BBC) essentially split the biotech universe into two groups. BBP invests in products stage companies. They have already successfully completed multiple human clinical trials and have received FDA approval to sell and market a drug. BBC invests in clinical trials stage companies.