It’s Friday, people are at home, but there’s no time like now to look at fixed-income and what’s going on with liquidity. ETF Trends CEO Tom Lydon hopped onto the ETF Report on Yahoo Finance Live at 4:15 pm ET with anchor Myles Udland and Yahoo Finance columnist Rick Newman to go over what’s happening in the ETF space.

Udland began the segment by pointing out what appears to be dislocations in the bond ETF market, as there have been substantial discounts to NAV (net asset value). Basically, the bond ETF wasn’t priced at what the underlyings would imply. With that in mind, Lydon explains how, over the last week, ETFs have been holding up very well. With all the volume, 45% of NYSE is made up of ETFs, and there’s been no news of actual problems.

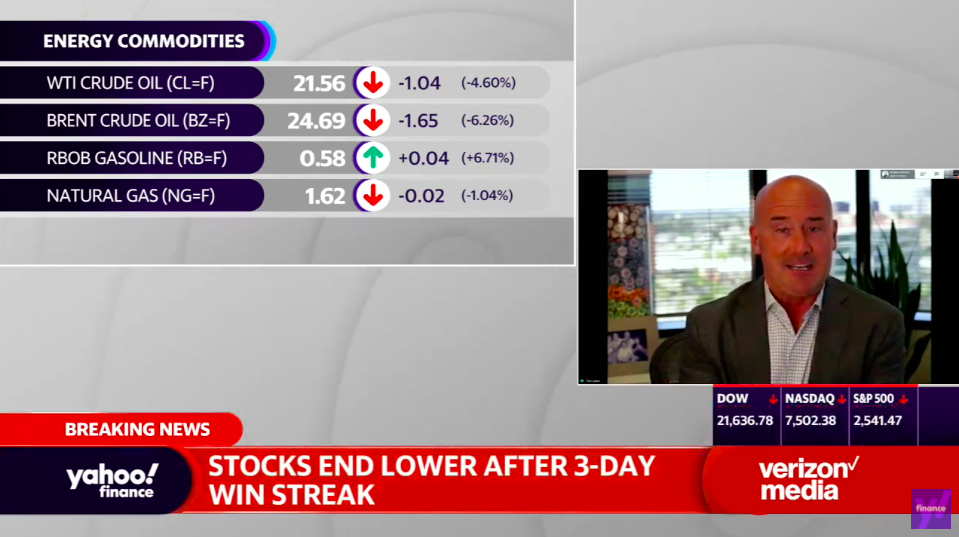

Watch the full Yahoo Finance segment by clicking the image below:

However, looking specifically at fixed-income, the thing to keep in mind is how underlying holdings are not priced every day. They don’t trade every day, which negates a purpose in that regard. So, in some instances, where mutual funds have to use pricing services, past prices are used and could be inaccurate.

As a result, an ETF may go into to buy the underlying shares, and then take those pieces of the bonds, and sell them back to the market place. However, in this case, they were not worth it. So, the underlying worth at the regular prices being taken to the pricing units were providing more accurate pricing than mutual funds.

With all the misreporting, it’s fortunate that a lot of these discounts have been settled. Some ETFs have even been selling at a premium these days. That in mind, it’s made for a good experience to go through.

“It shows how ETFs held up well during this period of volatility,” Lydon adds.

Volatility Vs. Liquidity

Newman joined the conversation with questions regarding active managers complaining that ETFs have contributed to volatility, along with a concern regarding the liquidity issues, and whether or not it has been resolved.

As Lydon makes clear, volatility has not been affected. In fact, liquidity has been benefiting in all of this. Within a fixed-income marketplace, because bonds are not traded on exchanges, but ETFs that represent them are, there’s a great situation available for people looking for exposure. So, all different types of fixed-income can go to the ETF market place and get it in something trading regularly.

“Most investors, over the years, have invested in individual stocks or mutual funds. What we’re seeing is ETFs are, in fact, are getting better pricing than mutual funds,” Lydon notes. “I think we’re going to look back on this in the months to come, as we are always weighing mutual funds vs. ETFs. But again, both serve certain purposes, but more and more, ETFs are earning their weight.”

Shifting topics, Udland asked about what notable areas inflows are moving towards. Lydon makes it clear that advisors are sticking with it, even as times have changed. With rebalancing coming up in the quarter, very few advisors have sold.

With that in mind, there has been much interest in areas like oil and other areas of volatility that haven’t been exacerbated by what’s going on overseas with Saudi Arabia and Russia. Additionally, there are inverse and leveraged ETFs out there that have continued to do well.

“Here’s a situation where you can take a small amount of money and get a decent-sized allocation for the portfolio. It’s not for the faint of heart, not for the average investor, but advisors have been using them, and they’ve been doing exactly what they’re supposed to do.”

For more market trends, visit ETF Trends.