“If you’re a value investor, number one, going to value–that makes a lot of sense,” said Lydon. “Number two, if you feel a lot of this is Trump’s posturing, which many people do, you have to believe at one point in time, they’re going to give a little, and when they do, it’s going to be the emerging markets who benefit the most.”

Lydon suggests looking at the WisdomTree Emerging Markets High Div ETF (NYSEArca: DEM), which seeks to track the price and yield performance of the WisdomTree Emerging Markets High Dividend Index. The index is a fundamentally weighted index that is comprised of the highest dividend-yielding common stocks selected from the WisdomTree Emerging Markets Dividend Index.

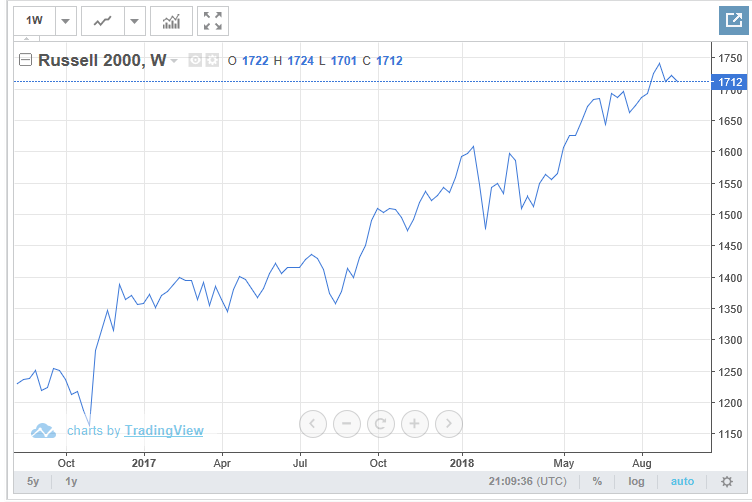

Big Opportunities in Small Caps

The extended bull market has been marked by the growth of FANG stocks like Amazon and Facebook being in pole position for much of the run, but this year has a also seen a rise in small cap equities as evidenced in the upward trajectory of the Russell 2000. Spurred by tax cuts that have been a boon to corporate profits and unlike emerging markets, immunity to changes in the dollar, small cap ETFs have been benefitting.

![]()

“Small cap companies are doing so much better because they don’t have to worry about the dollar, they don’t have to worry about trade and the tax cuts have been a huge benefit to them,” Lydon said.

Lydon recommends the Janus Henderson Small Cap Gr Alpha ETF (NasdaqGM: JSML), which seeks investment results that correspond generally to the Janus Small Cap Growth Alpha Index. The underlying index is composed of common stocks of small-sized companies that are included in the Solactive Small Cap Index, a universe of 2,000 small-sized capitalization stocks.

For more market news, visit ETFTrends.com.