![]() By Doug Sandler, CFA, RiverFront Investment Group

By Doug Sandler, CFA, RiverFront Investment Group

Dividend investing strategies have become popular in the US, attracting both equity investors desiring a lower risk way to participate in the bull market and traditional bond investors in search of higher yielding alternatives to cash or bonds. Over the last 5 years dividend stocks, which we define as the stocks represented in four common dividend indexes, have returned roughly 90% of the S&P 500.

Three factors lead us to support the fundamental rationale for owning dividend stocks. First, we think it is more difficult for dividend-paying companies to ‘cook the books’, since dividends represent tangible outlays of cash that can be more difficult to manipulate than earnings. Second, dividend paying companies, in our view, tend to be less risky, since the decision to pay a dividend often reflects the company’s stability and the fact that it generates more cash than it needs to maintain its operations. Finally, we believe dividend-paying companies tend to be better stewards of capital, because there is less cash for executives to spend on poor returning investments and non-strategic acquisitions. Note: dividends are not guaranteed and are subject to change or elimination.

While dividend-paying stocks in aggregate have been a rewarding asset class recently, some important divisions exist below the surface. In a strong bull market with falling interest rates the market pays less attention to these divisions. However, as the US bull market matures and interest rates rise, we believe it will become increasingly important to favor ‘high quality’ dividend portfolios. We believe that there are two important differences that distinguish a ‘high quality’ from a ‘low quality’ dividend portfolio: Construction & Constituents.

Construction: What makes a ‘High Quality’ Dividend Portfolio?

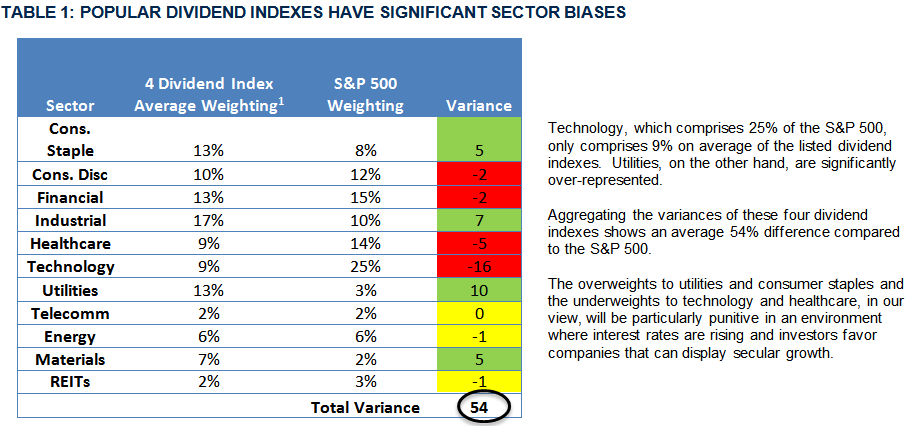

1) Sector Neutrality: We think a portfolio comprised of high-quality dividend companies does not necessarily make a high-quality dividend portfolio. We believe high-quality dividend portfolios possess sector allocations that closely mimic those of the broad-market. Significant sector overweights or underweights relative to the broad market, in our view, do not belong in high quality dividend portfolios. This viewpoint is not shared by many dividend-focused portfolio managers or index builders as demonstrated in Table 1, which compares 4 dividend indexes and represents nearly $80 billion in exchange-traded fund assets.

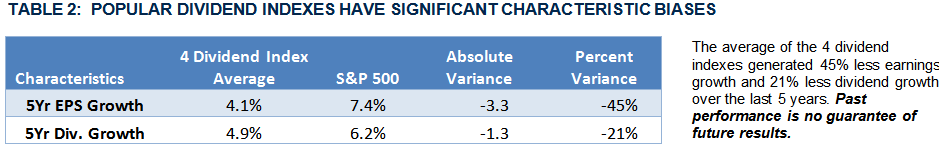

2) Characteristic (Factor) Neutrality: We believe dividend indexes tend to have an anti-growth bias for two reasons. First, they tend to overweight slower growing sectors like utilities, consumer staples and telecommunications; and underweight faster growing sectors like Healthcare, Information Technology, and Consumer Discretionary. Second, they tend to overweight slower growing stocks, like large-cap pharmaceutical, chemical and insurance companies, while underweighting faster growing biotechnology, Internet and specialty finance companies. This can create marked differences between the characteristics of the market and the dividend indexes. Several of these differences can be seen in Table 2.

Constituents: What makes a ‘High Quality’ Dividend Company?

- Dividend Growth or Initiation: One of the keys to dividend investing, in our view, is to focus on dividend growth and not dividend yield. We believe high-quality dividend companies consistently grow their dividends over time. Research published by Ned Davis Research covering the period from 3/31/72 to 10/31/17, shows that the returns of dividend growers have been superior to the returns of dividend non-growers or dividend cutters. Importantly, investors should not exclude recent dividend initiators from their consideration, in our view, since they have been among some of the fastest dividend growers over time. Many companies in the technology and banking sectors fall in the ‘recent dividend-initiator’ category.

- Dividend Protection and Capacity: Companies with reasonable levels of debt and reasonable dividend payout ratios are more likely to maintain and grow their dividends than those without, in our view. We believe this is because they have a cushion to weather challenging economic conditions and have the necessary capital to continue to invest in their businesses.

Bottom Line: With interest rates rising and the US bull market maturing, we believe it is now more important than ever to be ‘picky’ with regard to the composition and construction of a dividend portfolio. We favor high quality dividend portfolios, as described above and are further attracted to dividend stocks abroad given their higher dividend yields and more favorable macro-economic environment (very low interest rates and less mature bull market).

Doug Sandler, CFA, is Chief U.S. Equity Officer at RiverFront Investment Group, a participant in the ETF Strategist Channel.

[1] Nasdaq US Dividend Achiever Select Index, FTSE High Dividend Yield Index, Dow Jones US Select Dividend Index, and S&P High Yield Dividend Aristocrats Index. Shown for illustrative purposes only and not intended as a recommendation.