Investors hoping for a pure blockchain play are going to be very disappointed. BLCN reads a lot like a large cap tech ETF with some more focused blockchain businesses thrown in. Granted, each of these mega-techs is making meaningful investments into blockchain, but how much is that really going to impact the company’s bottom line?

Amplify Transformational Data Sharing ETF (BLOK)

As mentioned, BLOK is actively managed and, as such, may be better positioned to react to rapid developments in the space. In pursuing its investment strategy, the fund’s portfolio managers seek investments in companies across a wide variety of industries that are leading in the research, development, utilization and funding of transformational data sharing technologies. Their involvement in blockchain is defined as:

- actively engaging in the research and development, proof-of-concept testing, and/or implementation of transformational data sharing technology.

- profiting from the demand for transformational data sharing applications such as transaction data, cryptocurrency and supply chain data.

- partnering with and/or directly investing in companies that are actively engaged in the development and/or use of transformational data sharing technology.

- acting as a member of multiple consortiums or groups dedicated to the exploration of transformational data sharing technology use.

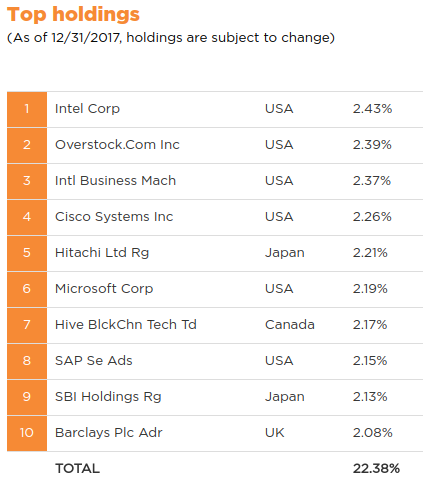

In this sense, the methodology of BLOK is similar to that of BLCN, except that it takes a more qualitative, human-involved approach. Despite the relative similarity in approaches, the top 10 of BLOK also looks much different than BLCN’s.

BLOK and BLCN only share five names in their top holdings, and BLOK is much more top-heavy (61% of assets in the top 15 holdings for BLOK, compared to just 32% for BLCN). Given its much larger focus on small caps, BLOK could have a bit more “boom or bust” potential. These companies can be more quickly and deeply affected by advances in blockchain, which could be either good or bad depending on how successful they are at blockchain development.

Conclusion

The SEC demanded that these two ETFs remove the word “blockchain” from their names, but investors appear to be having little trouble finding them. The two funds combined are poised to pass $100 million in trading volume on just their second, putting them ahead of the pace of the recent successful launch of the Marijuana ETF (MJX).

I like that both of these funds have a nice mix of both tech and financials exposure, about 85% of assets total in both funds, with a mix of about ⅔ tech and ⅓ financials. One of the biggest “concerns”, obviously, is that these ETFs are far from pure blockchain plays. Scanning through the holdings of each fund, I’d estimate that only about 10% of assets are near-pure blockchain plays. Currently, these funds are more large-cap tech and financials ETFs, but there’s a lot of blockchain-related growth potential here.

These funds are probably headed towards billion-dollar status at some point in the relatively near future. Even though BLOK is looking like the very early leader in the race between the two (it’s trading at about double the volume of BLCN), I like BLCN in the long term given it’s passive nature, its slightly lower expense ratio (it’s a very minor difference, but even small differences in expense ratios have shown to be big drivers in net flows) and more quantitative approach to stock selection. Given the current buzz around blockchain and cryptocurrencies, both of these funds have the look of successful launches.