“And we would go on as though nothing was wrong.

And hide from these days we remained all alone.

Staying in the same place, just staying out the time.

Touching from a distance,

Further all the time.”

Joy Division, Transmission

Over the last few weeks I’ve been digging deep into my own assumptions about how the world works. I’ve seen enough cool stuff fly by to (occasionally) recognize when I should keep my mouth shut until I actually wade into a topic. That’s largely how I’ve felt about Crypto. When Bitcoin took off about a decade ago, I did the obligatory amount of reading most nerds did, chuckled at all my Young Turk analysts buying Bitcoin for $49 or whatever it was at the time. I adopted the fashionable “Tsk, Bitcoin, but Hrm, blockchain?” stance that still pervades most of finance on the ‘Security-Notional’ side of the balance sheet — the world of stocks and bonds and futures and options and all that jazz. I wasn’t paying enough attention.

Background

I’m not writing this for all of you deep crypto nerds — y’all are the ones I’m learning from. I fully expect y’all to:

- Light me up over everything I’ve got wrong.

- Point out the people and groups that already figured this out, but whom I couldn’t find on Google this weekend.

But for the rest of you:

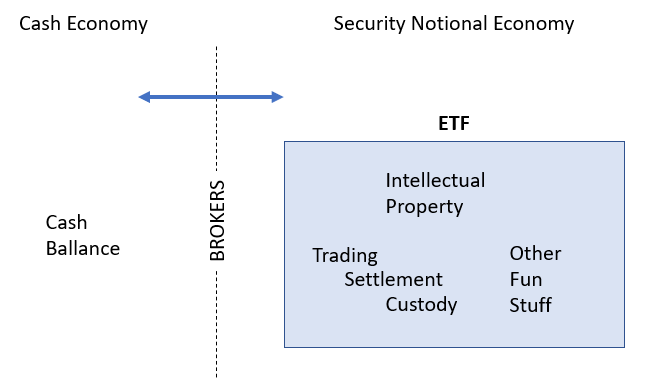

Let’s start by thinking about what the whole point of a mutual fund or ETF or SMA or CIT is to you as the investor. You move money from the Cash economy (where we actually accumulate and spend dollars) to the Security-Notional economy (where we own assets we mark to a “price”) through a brokerage account. That’s quite literally the point of your broker. They sit between the Cash Economy and the Security-Notional economy and help you transact in the later. You allocate money from your cash into, say, an ETF. That ETF is nothing more than a slice of intellectual property (IP), whether they come from MSCI as part of an index, or from Cathie Wood’s team at ARK Invest. That IP is then implemented through trades in underlying securities, through in kind creations or by taking cash from an Authorized Participant, and dozens of other fun but shockingly complex bits of work happen under the hood to keep the portfolio trued up (corporate actions, splits, M&A, securities lending, etc.) You can imagine it a bit like this:

So what are you really paying for? Well, sometimes the IP involved is expensive, and unique (like, say, the active management of ARKK). Sometimes it’s relatively simple and loaded with competition (like, say, MSCI’s large cap U.S. Index). You as an investor should expect to pay accordingly. You’re also paying for all the other stuff, but that tends to be relatively inexpensive. If your ETF is in U.S. stocks, you’d expect it to be cheap, but if its emerging market local currency debt with hedging overlays? Well, you’d expect to pay a bit more.

Dave’s Radical Rethink

Let’s tease this out and try to imagine the most efficient way this could work. The actual IP here is trivial to package up. It’s just a continuous broadcast of portfolio state, a carnival barker yelling “STEP RIGHT UP AND SEE TODAY’S S&P 500.” In the world of modern data, there’s little difference between publishing that daily in the Wall St. Journal and building an API that a computer could poke at on demand to get constituents. Even the most active manager does essentially the same thing: they just say what the contents of the IP are, all the time.

In order to get paid for that IP, we’ve created all sorts of systems. Most involve you literally giving the money to the IP holder, and letting them handle the rest. If you want access to ARK, you can buy a mutual fund or an ETF, or if you’re big enough, open up an SMA. But regardless, you move money across the notional barrier from your pile of cash into some Security-Notional vehicle, which ARK then manages. But what you’re really looking for is the IP. Index providers get paid a little differently – they license their intellectual property to pretty much anyone, but the real money is in licensing it to fund managers who package it up into ETFs and funds of their own. They also license their IP to media, researchers, data providers, and so on.

The implementation part turns out to be relatively annoying. So much so that we’ve created all sorts of products to avoid it: index futures in particular were created to avoid the friction of implementation (among other things). So were ‘synthetic ETFs’ in Europe or Exchange-Traded Notes here in the U.S., and of course a huge chunk of the derivatives markets from swaps to structured notes. The IP is what matters. The implementation is just friction.

Tokenized IP

The New Hotness, in case you missed it, is ‘Non-Fungible Tokens’ or NFTs. The idea of an NFT is pretty simple: it’s simply a digital blob that can’t be duplicated, and it is one of a kind. This is distinct from Bitcoin, which are digital blobs of which there are currently 18 million. Yours is exactly as useful as mine. With an NFT, you make a one and done for each token. You can ‘burn’ it, but you can’t change it, and it’s unique. This the idea behind the widely popularized NBA TopShot digital collectible … THINGS.

A Sidebar for Nerds: I am hung up on digital objects having utility, and I’m trying to get past it. I have opened countless ‘digital packs’ of ‘digital cards’ that I paid real money for to play a game called Magic: The Gathering. Those fake things had real utility to me, because I enjoy playing a game that I can only play if I have those cards. I have absolutely no emotional attachment to my ownership of them. At the very same time, I don’t, at my core, understand or appreciate the value of a piece of digital artwork which I could see in my browser right now for free, just because you tell me mine’s ‘official’. Give me copyright and let me put it on my business cards or sell it to Getty Images? Sure. But just to know I own one of 100 “real” copies that is now mine? Nope. I am 100% aware of the ridiculous double standard here, and I am not suggesting I’m correct. I’m saying it’s where I’m at right now.

Each card in a TopShot pack, or each piece of digital artwork on Rarible, OpenSea, or a dozen other platforms, is usually just a Smart Contract tied to the Ethereum network. (I wrote a bit about smart contracts last week, but in short, they take a bunch of business logic, embed it in a piece of publicly accessible code in the Ethereum blockchain, and run as cloud-computing applications using ETH as the way you pay for computing cycles. They’re cool.)

NFT’s ‘wrap’ other objects inside their smart contracts. So for example, if you buy a piece of digital art, the literal image could be wrapped in the token (the ones and zeros that make the GIF), or more likely, the token wraps a digital key that in turn unlocks a much higher resolution version. Since the token itself can be moved around and interacted with, there’s a cost to both how complex and how big the tokens can be in practice.

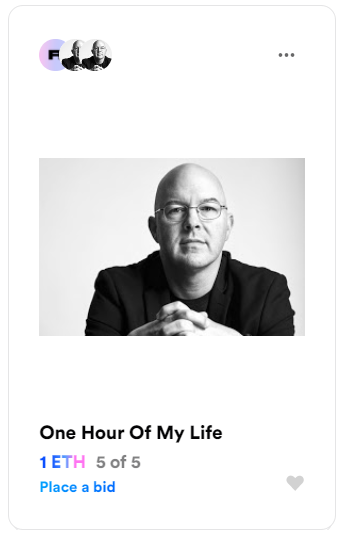

What you put into an NFT is entirely about trust. The NBA is wrapping up MP4s (or keys to them) in the body of their NFT. Other artists are putting keys to unlock music. I went to Rarible last night and minted 5 Non-Fungible Tokens of my own. I used their point-and-click tools and did no programming whatsoever.

Since I have no real talent, I decided the thing I would sell was an item of external trust. If you buy one of these tokens, all you own is my promise. And my promise is minted on the token: you can transfer the token back to me (which I will then destroy or resell), in return for me giving you one hour of my life.

(I am not expecting anyone to buy these. I’m making a bit of a point here: you can wrap anything in a smart contract, as long as you have a trust bridge. In this case the trust bridge is my word. If you think I’m unreliable, my promise is worthless. If you think I’m a person of my word, then the token is actually worth one of the projected 700,000 hours of my life. But feel free to buy it if you like!)

The process was relatively simple, but it wasn’t free. In order to mint these 5 tokens, I had to pay ‘Gas’ to mint my contracts and make them available for people to buy. Gas is the computational currency of the Ethereum blockchain. Minting my tokens meant I sent a set of code out to the blockchain. When some miner minted a new ETH block, my work was done (and I paid him, in Gas). My cost for this was about $40 at current ETH prices and the load of the network last night. To participate in this weirdness, I had to join the Crypto Notional economy. I had to purchase a little bit of ETH (which I did at Coinbase). Because I need a ‘hard’ wallet — a specific address on the blockchain that my new NFT’s belong to and are minted by — I had to move my ETH from Coinbase over to Metamask (one of many web-based hard wallets). I could also have used a wallet on my phone, or even resorted to writing a long string on paper somewhere.

Once I spent some cash at Coinbase to get into the crypto side of the house, everything that happens with this token happens only in the Crypto Notional economy. If you want to buy one of my tokens (guaranteed only one of 700,000 it would be possible to make!), you’re going to owe me an ETH (the minimum Rarible lets you mint a token for, I’m not that much of a egotist). How much this is worth to you, as a buyer, will depend on at least two things: how much you value Ethereum, and how much you value an hour of my time. It would be easy to say “well, the first is just an exchange rate,” but since we both now need ETH to interact, (and it’s easy to imagine all the internety-things ETH could be used for), ETH has utility beyond its simple conversion back and forth to USD. It is itself a useful good required to buy computing cycles from the cloud to implement smart contracts.

Oracles and Portfolios

One really cool and still somewhat nascent feature of smart contracts is the idea of an Oracle. An Oracle is an external provider of data to a smart contract. So for example, if you have a contract that pays out on who wins a presidential election, you could assign a specific Oracle to have the contract consult to determine who won (Associated Press, etc). The beauty of such a system is that you can have information enter the smart contract without any human involvement and without creating a giant bloated mass of a smart contract which would cost far too much gas to run.

Put another way, an Oracle to a Smart Contract is simply a way of accessing a piece of intellectual property that lives OFF OF the blockchain – the state of an external data set. So what if a PM or an Index provider, instead of running money, simply provided an oracle: an API that any (approved, secured) system could talk to which told the requestor in real time what a given portfolio looks like: 4% AAPL, 2% TSLA, etc. (This is essentially what CRSP does right now in their partnership with Symbiont and Vanguard, but to my understanding, that’s effectively a closed network, in the same way FedWire is. They just use blockchain for fault tolerance and efficiency.)

So this part is pretty well trod: baking portfolio IP into a blockchain. What’s the next step? Getting paid.

When you buy an NFT, you’re not just buying whatever IP got wrapped up in the contract, you’re also getting access to a whole set of business logic coded into the NFT. In the dominant standard for digital art, ETC-721, a standard for paying royalties exists (and is part of my NadigHour tokens). If you decide to sell my token to Elon Musk for $1 million in a decade because I discovered the secret to time travel and it’s a collectible (I won’t, and it won’t be), 10% of that transaction will get funneled back to the same ETH address I used to mint the coins. That’s really cool for, say, an artist who’s actually selling copyrights.

But back to indexing: coding up a smart contract to access an oracle that happens to return the constituents of an index or portfolio is pretty much trivial, but so what? If we stopped right here, what we have is a really interesting way of getting IP into direct indexing accounts. After all, this could just power all my fractional share trades at OSAM’s Canvas or whatever Schwab launches this year. That’s just a fun new way of sending a spreadsheet, often, with a lot of security and transaction history.

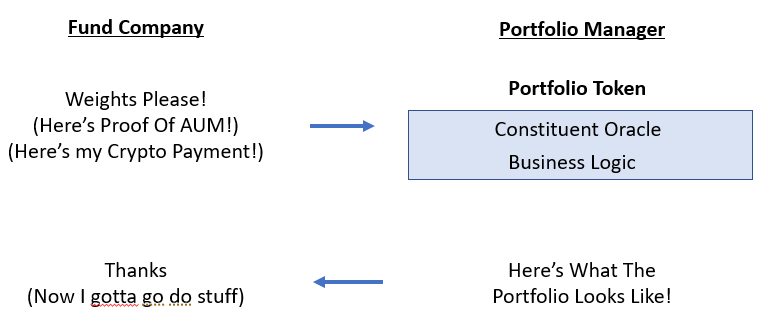

From Oracles to Funds

But what if a new kind of ETF (call it the CryptoETF) could access this information as a Portfolio Token? For example, Matt’s Index issues a Portfolio Token to the Dave’s Large-Cap CryptoETF (cDAVE). It’s a singular NFT — it exists to create the connection between Matt’s Index and the CryptoETF, and its precise terms could be negotiated. Whenever the CryptoETF wants to adjust its portfolio (could be once a day, could be every second), they access the functions of the smart contract that is part of the Portfolio Token. As part of that access, the CryptoETF presents evidence of AUM, and remits payment (based on daily AUM over time, just like now, perhaps) to Matt’s Index (in a tokenized store of value, like a stable coin) in return for that instance of access. Baking in the appropriate business logic here is absolutely trivial. The programming language used for smart contracts, Solidity, is ludicrously straightforward for anyone who has ever learned JavaScript (which at this point should cover every programmer born since 1970).

From Funds to Implementations

What’s even cooler is if to imagine a world where the Fund Company side of this transaction exists entirely in the Crypto Notional economy. What if the fund itself was simply a set of cryptographic assets. Instead of own individual stocks, say, they could own tokenized stocks. This is effectively what happens over at FTX (U.S. investors need not apply). FTX runs an exchange where you can trade token pairs (I give you an apple, you give me an orange). In order to make the apples say, bitcoin, and the oranges, say, Tesla Stock, they partnered with a brokerage to essentially create a giant public dark pool. Everyone opens up dual accounts with both FTX and their Security-Notional brokerage partner, CM-Equity, and FTX allows members of the dark pool to trade these token pairs with each other, which are then mimicked in the dark pool being run by CM-Equity (essentially). Each each token, in a way, represents a share in the dark pool run by the Securities Notional partner, assigned to a certain exposure (say, a share of TSLA). It’s far to complex and fraught with single-counterparty risks (my opinion, feel free to yell at me), but I get why they ended up this way. Regulators are terrified, so you have to play ball with securities laws.

A far more efficient way to bridge this gap between the Security-Notional ownership of $TSLA stock and the tokenized Crypto-Notional version of TSLA would be to simply establish bridged liquidity pools. This is the topic for an entire different discussion, but essentially, the Uniswap model for managing liquidity in any pair of assets is quite elegant, and there’s really no reason (other than regulation) you couldn’t apply it to any single asset class.

Very briefly, each notional tradable pair (say, a stable coin like USDT vs. TSLA stock) would exist as its own pool of both (some USDT and some TSLA) to create an ‘Exposure Token’, which is what gets traded. When it gets out of balance, prices change to create arbitrage opportunities. This is how Uniswap handles a swap between, say, Ethereum and Bitcoin:

(I get that I’m shorthanding an *enormous* amount here and I apologize, but I encourage ops nerds like me to dig in. It’s super cool, and embeds all sorts of economics, like paying liqudiity providers for showing up beyond just providing an arbitrage opportunity).

Right now, such a bridge token would likely violate a whole pile of securities laws in the U.S. — which is exactly what we need to fix. But lets hand-wave that. If the fund company could, instead of going and buying a bunch of stocks on the Security-Notional side of things, instead simply go and buy a bunch of Exposure Tokens on the Crypto-Notional side of things, the implications are profound:

- A ‘CryptoETF’ simply becomes a collection of tokens.

- The CryptoETF itself, now just a collection of tokens tied to an external Portfolio Token which contains the IP, can implement business logic, and itself be tokenized.

- The CryptoETF token presents methods for automatically accessing creation and redemption — n ew CryptoETF tokens are created or burned based using baskets of the appropriate Exposure Tokens (tokenized TSLA, tokenized gold, whatever), which could of course change at any time based on new information from the Portfolio Token.

- Any changes to the portfolio of any kind can be 100% automated — because all you’re doing is swapping Exposure Tokens for Exposure Tokens. If the fund needs to sell some Apple and buy some Tesla, the business logic of the CryptoETF can just automatically make the paired transactions back to a decentralized exchange like Uniswap.

- Since the CryptoETF is itself tokenized, it can be transferred through Decentralized Exchanges, presented as collateral, or just stored somewhere, all without any direct involvement of the current global securities infrastructure (that’s up to the liquidity providers).

Back to the Now

My ‘aha’ moment here is that all of the above is so trivial, technically. The entirety of this could be coded into Ethereum-based tokens in a weekend (by someone else, I’m tired) using existing tech. It’s also 100% impossible in the current regulatory environment. These Exposure Tokens could naturally be regulated entities with any counterparty risks or structural issues backstopped by our good friends at the DTCC. While that might make crypto-evangelists break out into hives, any bridging to the Security-Notional economy is going to require a counterparty to at the very least act as custodian for the Security-Notional side of the tokens, until we actually get rid of stocks and bonds altogether and just issue ownership rights directly to a blockchain.

All this is what i meant when I said last week that the United States has a real opportunity to lead here. Really thoughtful regulatory environments could turn the United States into the de facto global capitalist engine for the next 50 years. The path we’re on is one of almost complete neglect. A little poking around the edges of central bank digital currencies doesn’t cut it.

So what’s the to-do list? Build standards. Build a regulatory framework supporting those standards. Implement. That’s how this always works. The crypto community should be working hand in hand with regulators to make this future, not in conflict with, but in collaboration with the traditional Security-Notional economy. And doing so would put the U.S. back conducting the train of global capitalism, instead of hanging out in the caboose.

—

A Postscript on Bitcoin: I’m a well documented Bitcoin skeptic, as I am of all psychological commodities. I am however becoming slightly less of one because of a single realization: Bitcoin, more than anything, is collateral. It’s a crypto-native asset that is widely held, traded, and valued. That’s why folks like FTX and Binance treat Bitcoin as nearly-cash when it comes to posting collateral into a trading account on which to earn interest or gain margin, although even there, everything is marked at a USD amount. You can build an ecosystem to get away from fiat currencies, but it’s gonna be a whole ‘nother matter to get away from a peg.

Final Note: Ideas are ephemeral and implementation is everything. If you’re already doing all this, please let me know. I’m sorry I missed you in my google search. If you think this is a cool idea and you go build some giant thing around it, feel free to put me on your board or buy one of my tokens (grin).