![]() By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Our investment management process is built on the idea that behavioral economics is a major factor in successfully achieving the goals of an investment plan, especially for individual investors and families. We believe that we can help investors improve results through the use of techniques inspired by behavioral economics, such as our risk-first approach, blending strategic and tactical investments together, and having an airbag methodology like our Cash Indicator. We are very excited that the 2017 Nobel Prize in Economics was awarded to one of our biggest influences, Dr. Richard Thaler, for his work in the field of behavioral economics. We thank Dr. Thaler for his inspiration and congratulate him on this honor.

Regarding the U.S. economy, we think the current business cycle can continue for years on the condition that the U.S. Federal Reserve (Fed) does not make a significant policy error. Up to this point, we have been comfortable with the Fed’s policy moves since the spring of 2016 when they put further rate hikes on hold until this past December.

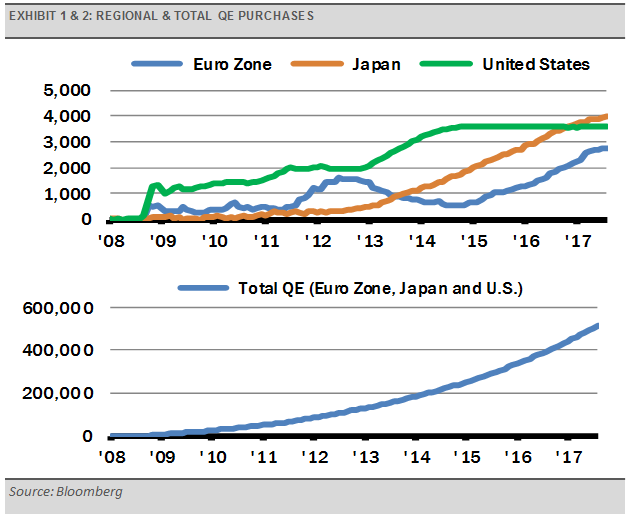

Meanwhile, global central banks continue to employ stimulative policies that should allow economic growth to continue. While the Fed is expected to raise short-term interest rates again, in addition to slowly reduce the size of its balance sheet, both the European Central Bank (ECB) and the Bank of Japan (BOJ) continue to stimulate the global economy through low interest rates and balance sheet expansion (exhibits 1 and 2).

The GOP released the outline of a tax reform plan that will likely only have a marginal impact on the economy. Aside from a near-term boost based on optimism, we expect that any material increase in economic activity will be offset by tighter Fed monetary policy. The Fed has stated that they think inflation risk is building and an increase in economic activity from a tax stimulus will likely be met by a more aggressive stance.

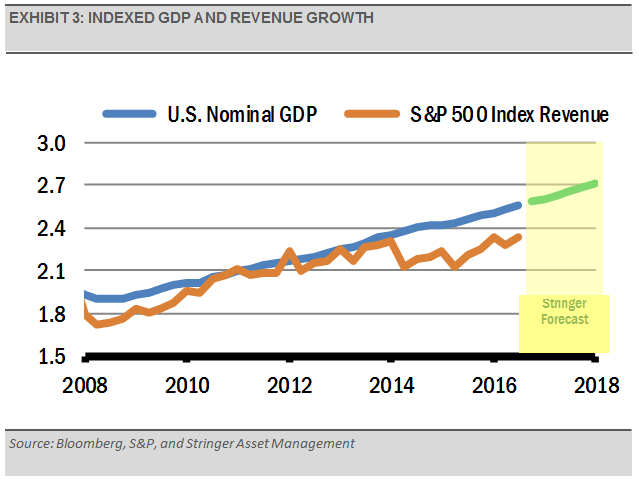

We think U. S. real GDP growth for the remainder of 2017 and 2018 is likely to be around 2.0% – 2.5% annualized. Adding 2.0% for inflation brings us to our nominal GDP forecast in exhibit 3 below. The signals we track generally suggest an increase in economic activity continuing the rest of this year and into the next due to gains in consumer spending and business investment.

The global economy is likely to continue growing for years, which should create a constructive atmosphere for equity investors. A growing economy increases the potential for corporate revenue and earnings growth (exhibit 3). As a result, and despite periods of volatility, we expect equity prices to march higher.

Importantly, healthy economic news is not exclusive to the U.S. economy. For example, Japanese exports are up 18%. Meanwhile, Germany’s factory output increased by almost 3% in August, its biggest increase in six years.

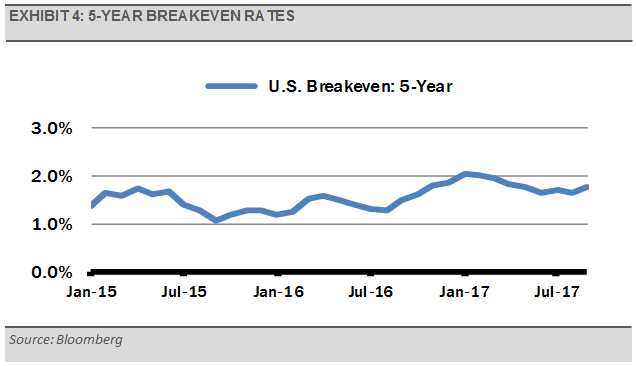

That said, long-term interest rates will likely remain range bound near their current levels. We think that insatiable global demand for high quality debt will keep interest rates low. Market-based inflation expectations have also dropped since last fall’s economic optimism (exhibit 4), which reduces upward pressure on long-term rates.

Overall, we have a constructive view towards the global economy. Most of the leading indicators we follow are in positive territory, consumer spending is solid and capital expenditures appear to be on the rise.

INVESTMENT IMPLICATIONS

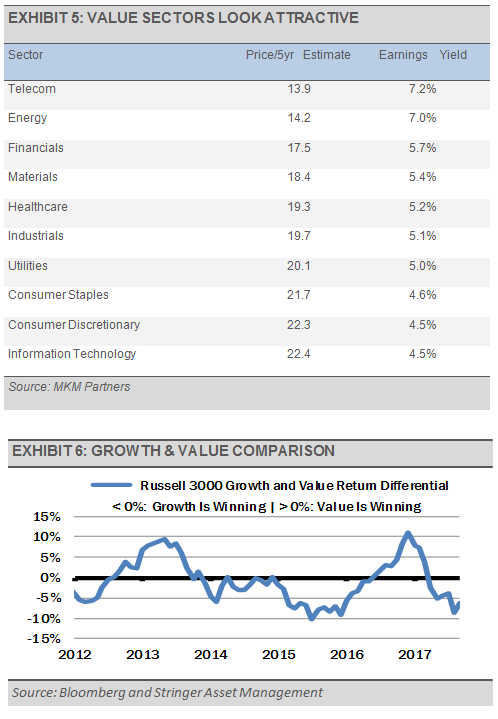

Within our equity allocations, we are favoring the financials, health care, industrials and materials sectors. We maintain our value bias despite it lagging growth this year. We think the recent outperformance of domestic growth stocks relative to value has mostly run its course (exhibits 5 and 6). Our equity allocations are trading at roughly a 10% discount to the global equity market due to our value bias. Furthermore, our strategies have a significantly higher yield than the market. Trading at a discount and getting paid to wait sounds like a good formula to us right now.