FAANG (Facebook, Amazon, Apple, Netflix, Google) stocks were all the rage at the height of last year’s bull market peak, particularly for investors reaping the rewards of a strong tech sector. Like fashion, however, technological trends can also be subject to obsolescence and today’s tech might be yesterday’s news.

This is where disruptive technology can assume the mantle as the next wave of technology that will power the world. However, with sensitive subjects like the replacement of humans with robots, which could possibly lead to massive job loss, are financial advisors ready to discuss these types of opportunities with investors?

That question was posed to Virtual Summit attendees and the results were a resounding “yes.”

As such, advisors need to look ahead to see where the future opportunities may lie and that could be in disruptive technology where fields like robotics and artificial intelligence could lead the next technological revolution. These opportunities were discussed at the 2019 ETF Virtual Summit with a panel of experts who are privy to disruptive tech and its future.

On the Inside the Disruptive Technology Revolution panel:

- Paul Dellaquila, Managing Director, Global Head of ETFs at Defiance ETFs

- Matthew Weglarz, Director and Portfolio Manager, Tortoise

- Catherine Wood, Chief Investment Officer and CEO, ARK

How does one define disruption in the technological arena? Each expert offered their own interpretation, but the common denominator is that disruptive innovation revolutionizes a process and changes it in a way where it almost makes it unrecognizable.

“Disruptive innovation is going to change the world works,” said Wood. “It’s doing to cause a lot of disintermediation.”

Disruptive technology is not relegated to certain sectors as it will permeate into all industries in some form or fashion. For example, augmented reality is technology comprised of digital images superimposed over the real world, and its use is primed to drive industry growth–industries like real estate and manufacturing are already putting the technology to use in a variety of ways.

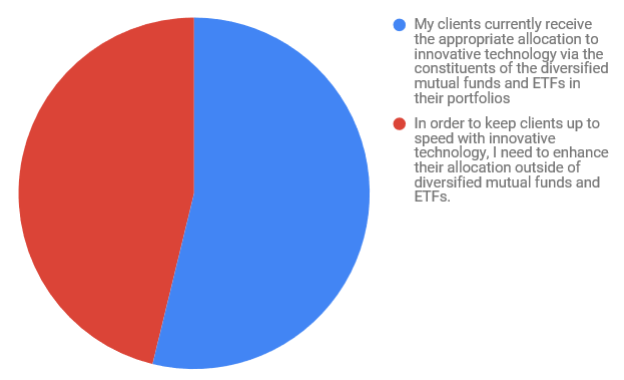

The question was asked during the segment regarding disruption: Which best describes your 2019 outlook?

The following choices were given:

- My clients currently receive the appropriate allocation to innovative technology via the constituents of the diversified mutual funds and ETFs in their portfolios

- In order to keep clients up to speed with innovative technology, I need to enhance their allocation outside of diversified mutual funds and ETFs.

The results were split with 53.80 percent answering to the former while 46.20 percent spoke to the latter.

The key takeaway is that the market environment is living in a world that’s rife for disruption. As such, it’s necessary for advisors and the whole financial market space to keep up-to-date on the latest technology–now and the future.

So what ETFs are best to capitalize on this forthcoming disruption?

Those were also discussed so don’t get left behind and watch the Virtual Summit, which is available on-demand now: https://www.etftrends.com/virtual-summit.