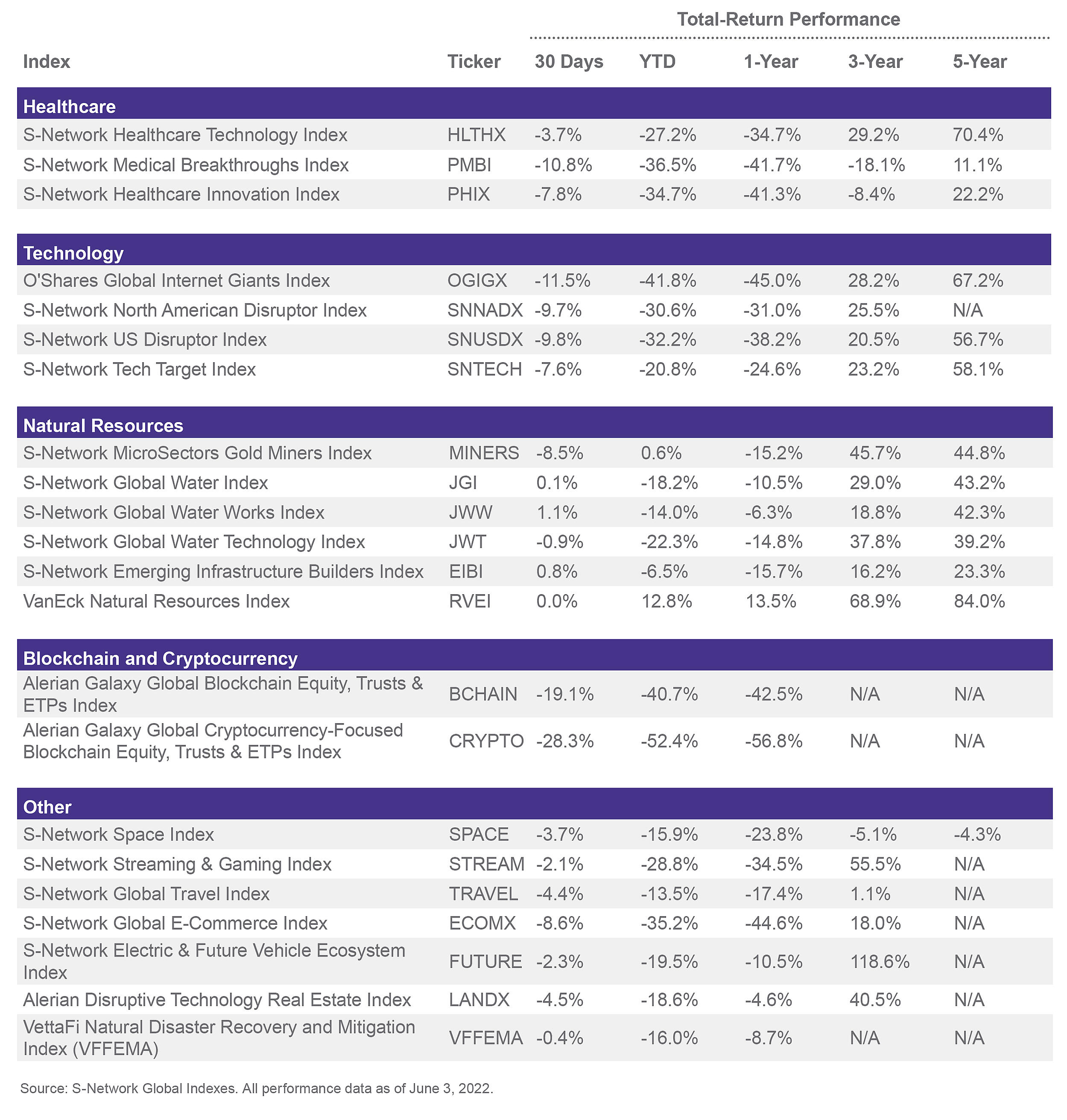

E-commerce growth has been a multi-sector trend for several years—growing alongside internet/mobile usage and supporting a global push toward faster, on-demand access to goods and services. But as e-commerce sales start to normalize to more sustainable levels, e-commerce related stocks have felt pressure in 1Q22 against almost two years of strong comps. Combined with negative sentiment toward the broader tech and internet sectors, inflationary cost pressures (e.g., fuel, shipping, wages) have contributed to the S-Network Global E-Commerce Index (ECOMX) falling 35.2% YTD. Despite softness in equity prices, early 2Q22 data suggest that e-commerce subsectors are still gaining market share and e-commerce related jobs are increasing, suggesting that long-term demand for e-commerce could eventually outweigh these short-term pressures.

Overall e-commerce demand and sales are still relatively strong.

The United States Census Bureau released its 1Q22 retail e-commerce sales report on May 19, and results generally supported 1Q22 management commentary that e-commerce growth rates were slowing, but still strong on an absolute basis compared to pre-pandemic quarters. U.S. e-commerce sales grew 6.6% y/y on top of 46.7% growth in 1Q21 and 20.0% growth in 1Q20. As a percentage of total retail sales, e-commerce fell slightly to 14.3%, which was still much higher than the 10% range seen throughout 2019. Additional data from Mastercard’s Spending Pulse provides similar insight past 1Q22 into the current quarter. During April, e-commerce growth fell 1.8% y/y compared to in-store sales which grew 10.0%. However, compared to April 2019, e-commerce sales were up 92.0%, while in-store sales were up only 5.2%.(1)

Most segments in e-commerce either maintained or grew their share relative to brick-and-mortar sales.

While the first chart is more widely used, the U.S. Census Bureau also provides (not as widely used) segment level detail on a seasonally unadjusted basis. Since data are unadjusted for seasonal patterns, 4Q e-commerce market share often skews higher due to disproportionate online shopping during the holiday season—particularly evident in clothing and general merchandise. Comparing 1Q data to 4Q data often looks more negative than it really is, but when comparing 1Q22 to historical 1Q data, it is evident that most segments of e-commerce are either maintaining or growing their market share relative to in-store sales.

Recent cost inflation has outweighed remaining strength in e-commerce.

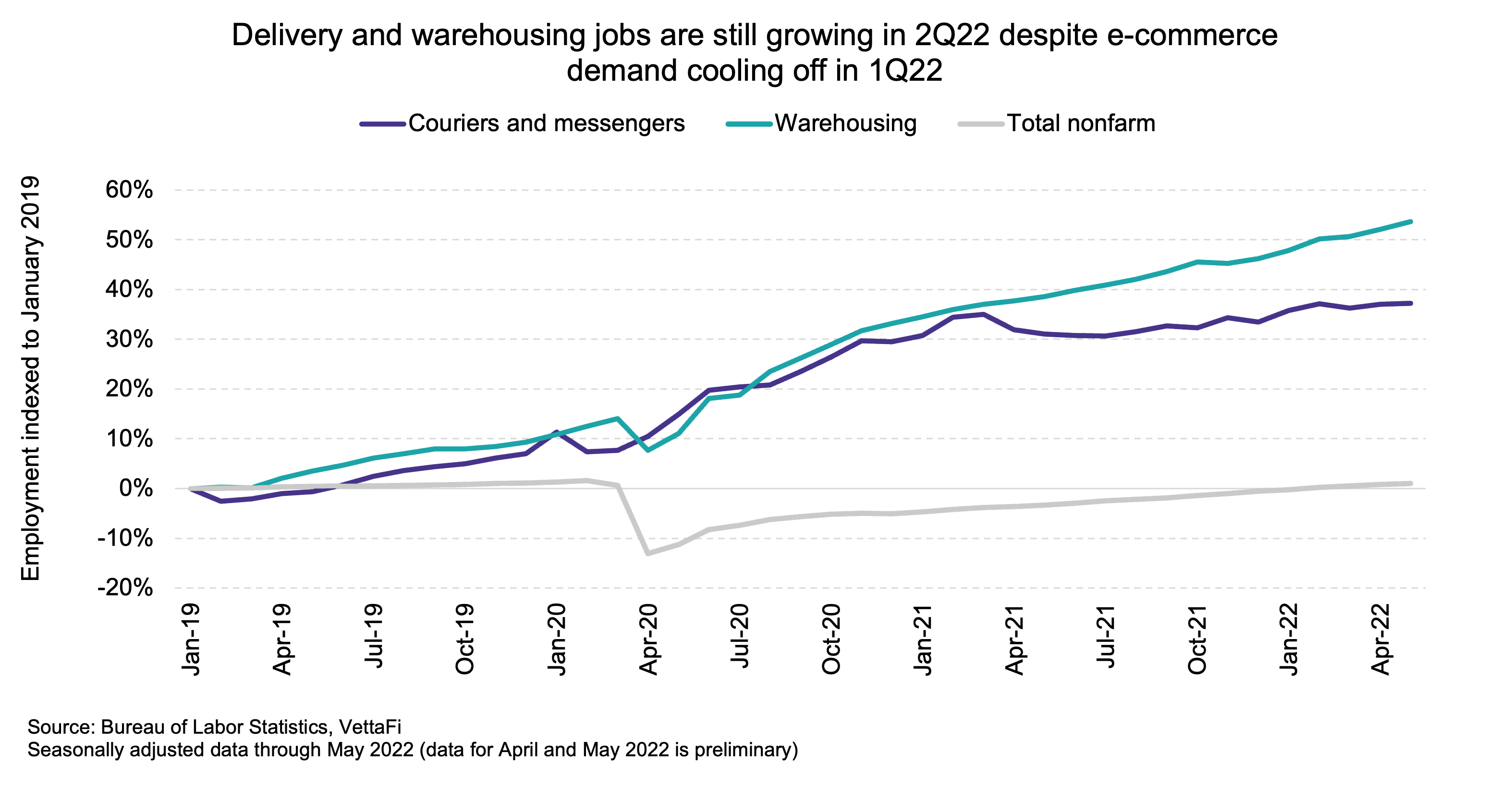

Broadly across constituents in the ECOMX index, top line revenue was not significantly hurt since reduced demand was partially offset by increased unit revenues. But both retailers and online marketplaces felt higher pressure from shipping and transportation costs. For example, Carvana (CVNA, 0.4% index weight) sold 13.8% more units in 1Q22, while revenue grew significantly more (up 55.8% y/y) due to higher used vehicle prices. Despite higher top-line revenues, gross profit per unit declined 20.4% y/y from higher shipping costs stemming from supply chain inefficiencies, Omicron, and severe weather events.(2) Higher transportation costs from shipping companies were attributed to higher cost inflation including fuel prices. On June 7, western railroad Union Pacific (UNP, index weight 1.8%) announced that while margins are still forecasted to improve from last year, margins will likely fall below previously announced guidance. But these cost pressures are generally short-term in nature and logistics companies are continuing to hire employees particularly in the last-mile space, which contributes to a strong long-term outlook. Preliminary figures show that e-commerce related logistics jobs like messenger/couriers and warehousing increased sequentially in both April and May even after modest 1Q demand data.

Bottom Line:

While cost issues and a normalization in demand contributed to some of the recent weakness in the e-commerce sector, long-term demand fundamentals are still relatively strong. E-commerce demand is still broadly positive compared to pre-pandemic levels and going forward, moderate levels of growth should be more sustainable and easier to manage for e-commerce companies. Even though evidence shows that e-commerce growth slowed in 1Q22, early 2Q22 data shows that spending is still far above 2019 levels and supply chains are still continuing to add employees.

For more news, information, and strategy, visit the Thematic Investing Channel.

Related Research:

Investing in E-Commerce: The Future of Search, Shop, & Ship

LANDX Provides Solid Ground for Future of Disruptive Tech

Holiday Travel Metrics Suggest 2022 Won’t Be 2020, Too

Investing in Space: Satellites Show the Big Picture

Investing in Electric Vehicles: What the FUTURE Could Bring