When it comes to defensive sectors, the groups that usually garner that label are consumer staples, healthcare, real estate and utilities. The technology sector and exchange traded funds (ETFs), such as the Technology Select Sector SPDR ETF (NYSEArca: XLK), are widely viewed as cyclical, not defensive ideas.

However, some analysts see defensive traits in the technology sector, the largest sector weight in the S&P 500.

“Credit Suisse Global Head of Equity Strategy Andrew Garthwaite and his team, who produced a remarkable finding in a note to clients earlier this month: Technology stocks, long viewed as the textbook definition of a cyclical sector, actually have many of the attributes typically found as part of a defensive strategy — particularly their vast holdings of cash,” reports Dave Morris for MarketWatch.

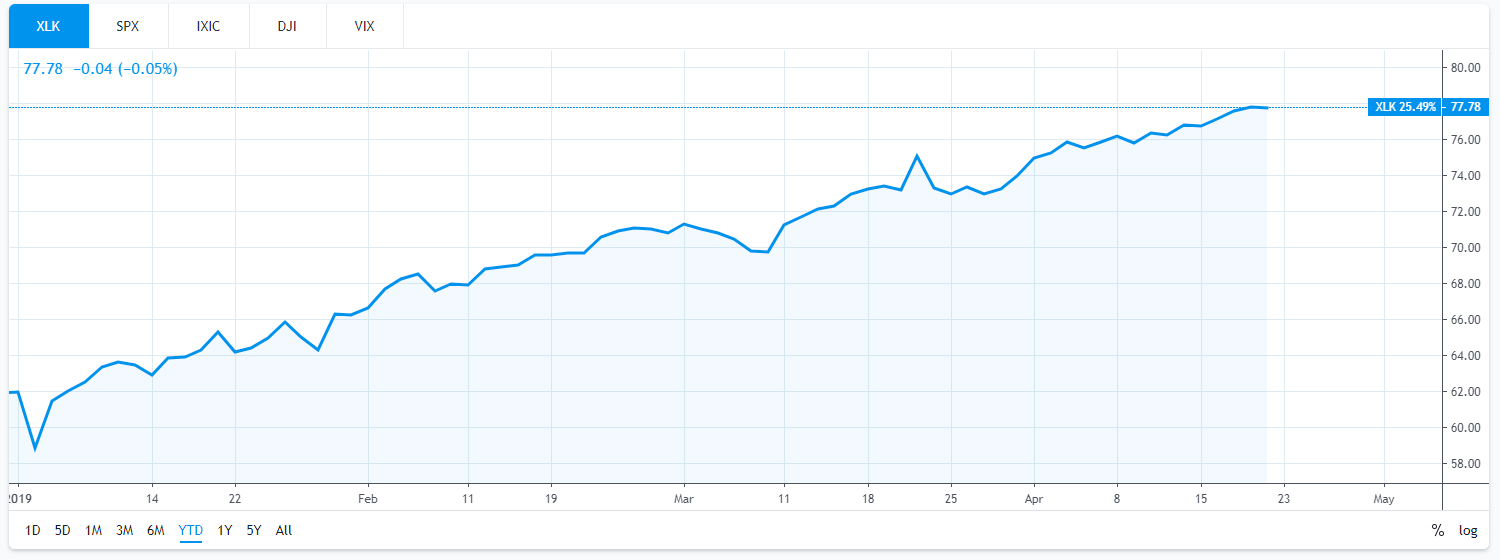

XLK ETF YTD Performance Through April 22, 2019

Growth Opportunities

Many investors embrace technology stocks and ETFs for the sectors growth prospects and those catalysts, including 5G, are abundant. Some market observers believe the rally in chip stocks can continue, particularly if investors remain enthusiastic about 5G.

5G technology will use a higher frequency band versus the current 4G technology standard, resulting in faster transmission of data. Being able to transmit copious amounts of data at a faster rate is certainly of benefit for wireless companies and their users, but 5G could be a major disruptor in various industries. Before this occurs, however, the infrastructure to accommodate this enhanced technology must be in place.

“The first area where tech shines is, unsurprisingly, in growth. Garthwaite showed that sales growth for U.S. technology companies has been 5 to 10% higher than that of the overall market for years,” according to MarketWatch. “He expects growth will continue on the back of developments such as the rise of 5G cellular networks and unlimited data plans, more semiconductor chips in autos, improvements in battery life disrupting numerous industries, and even more activity in online shopping.”

Related – Virtual Summit Recap: Getting Inside the Disruptive Revolution

The tech sector’s massive cash pile bolsters its defensive properties.

“The tech sector is the only sector globally to have net cash,” said Garthwaite, according to MarketWatch. “This is an important advantage at a time when we believe the credit spreads are likely to rise.”

For more information on the tech segment, visit our technology category.