The Covid-19 pandemic is already seeing the rise of robotics as social distancing measures are allowing machines to supplant humans in order to control the spread of the virus. However, the robotics movement was already apparent before the pandemic with countries like South Korea leading the way.

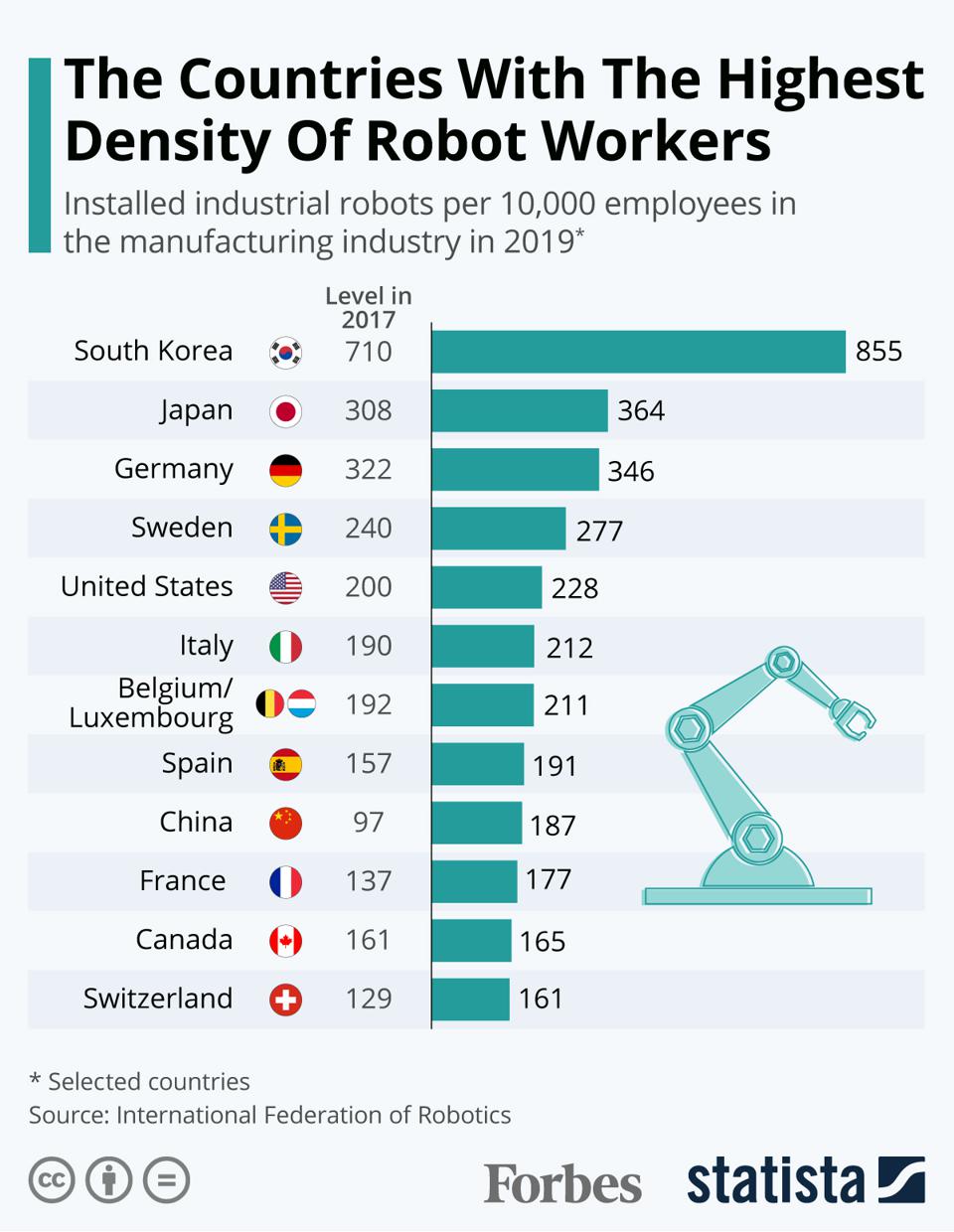

“The rise of the machines has well and truly started. Last week, the International Federation of Robotics presented new data showing that 2.7 million industrial robots were operating in factories around the world in 2019, the highest level in history,” Niall McCarthy wrote in a Forbes article.

“Despite sales of new robots declining 12% on 2018, 373,000 units were shipped globally last year, representing the third highest sales volume ever recorded,” the article added. “Asia is the strongest market for industrial robots with China’s operational stock climbing 21%. Demand is particularly strong in India where the number of units has doubled in five years and it now has the third highest volume on the continent after China and Japan. When it comes to robot density, there are now 113 units per 10,000 workers globally.”

At the very top of that list was the country of South Korea followed by Japan and Germany to round out the top three.

South Korea and Robot ETF Options

ETF investors who sensing an opportunity in this data can look to invest in South Korea via the iShares MSCI South Korea Index (EWY). EWY seeks to track the investment results of the MSCI Korea 25/50 Index, which is a free float-adjusted market capitalization-weighted index with a capping methodology applied to issuer weights so that no single issuer of a component exceeds 25% of the underlying index weight, and all issuers with a weight above 5% do not cumulatively exceed 50% of the underlying index weight.

Furthermore, ETF investors can also take advantage of the proliferation in robots and artificial intelligence (AI) via the Global X Robotics & Artificial Intelligence Thematic ETF (NasdaqGM: BOTZ). BOTZ seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

Additionally, BOTZ seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Robotics & Artificial Intelligence Thematic Index. The index itself captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries.

For more market trends, visit ETF Trends.