It could be a wild ride for the markets in an election week, which should spur a demand for investors seeking safe havens. In the case of silver, price action in December futures could dictate what the precious metal will do through the rest of 2020. Currently, fortune slightly favors the bulls.

“December silver futures bulls still have the overall near-term technical advantage but a price uptrend on the daily bar chart has been negated and bulls need to show more power soon to avoid serious near-term technical damage,” wrote Jim Wyckoff in Kitco News. “Silver bulls’ next upside price objective is closing prices above solid technical resistance at the October high of $25.71 an ounce. The next downside price objective for the bears is closing prices below solid support at the September low of $21.81. First resistance is seen at the Thursday’s high of $23.65 and then at $24.00. Next support is seen at this week’s low of $22.625 and then at $22.25. Wyckoff’s Market Rating: 6.0.”

One way to get silver exposure via ETFs is the Global X Silver Miners ETF (SIL). SIL seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index.

SIL gives investors:

- Targeted Exposure: SIL is a targeted play on silver mining.

- ETF Efficiency: In a single trade, SIL delivers efficient access to a basket of companies involved in the mining of silver.

Other Silver ETFs to Consider

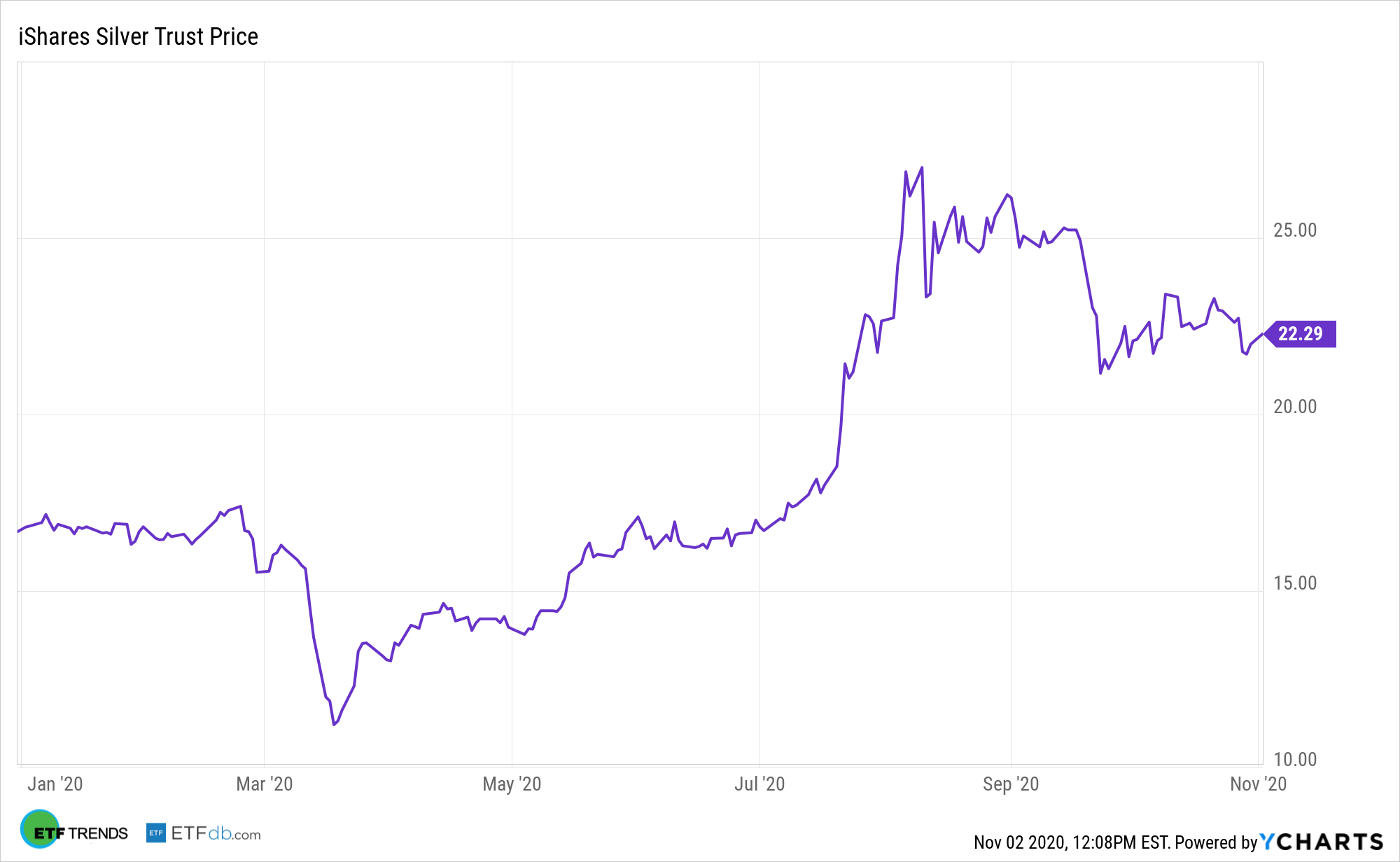

Other silver ETF options include the iShares Silver Trust (SLV). SLV seeks to reflect generally the performance of the price of silver. The Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities. It is not actively managed. The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of silver.

Another fund to consider is the Aberdeen Standard Physical Silver Shares ETF (SIVR). SIVR seeks to replicate, net of expenses, the price of silver bullion. The shares are backed by physical allocated silver bullion held by the custodian. All physical silver held conforms to the London Bullion Market Association’s rules for good delivery.

Another fund to consider as a backdoor play on silver is via miners in the ETFMG Prime Junior Silver Miners ETF (SILJ), which recently surpassed the $300 million in assets. The fund seeks investment results that correspond generally to the price and yield performance of the Prime Junior Silver Miners & Explorers Index.

For more news and information, visit the Thematic Investing Channel.