Seeking to capitalize on the growing gaming industry, Roundhill Investments is playing up its new ETF, the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSEArca: NERD).

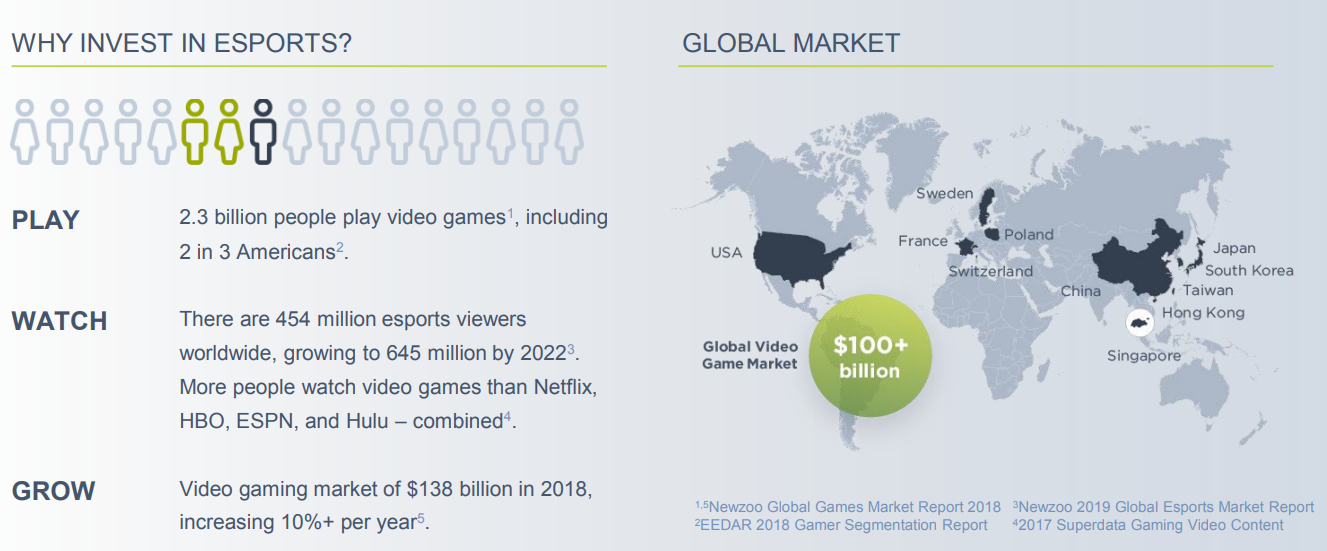

Projected global gaming revenues are expected to climb from $138 billion in 2018 to $180 billion in 2021. Such large projections have some industry watchers wondering if the numbers are over-inflated. But according to self-professed gamer, Tim Maloney, who is co-founder and CIO at Roundhill Investments, the opportunity is real.

“There is a lot of excitement that is being driven by the eyeball numbers,” he admitted in an interview with Yahoo! Finance. However, he said, “I do think the opportunity is here to stay.”

Top holdings for NERD include Sea Limited (SE), Activision (ATVI), Huy (HUYA), Take-Two (TTWO), and NetEase (NTES). NERD follows the Roundhill BITKRAFT Esports Index (NERD Index), the first rules-based index designed to track the performance of the growing market of electronic sports, or “esports.” The Index consists of a modified equal-weighted portfolio of globally-listed companies who are actively involved in the competitive video gaming industry. This classification includes, but is not limited to video game publishers, streaming network operators, video game tournament and league operators/owners, competitive team owners, and hardware developers.

“The reason for having an index in an ETF of the different publishers is because it’s a hit-driven business,” Maloney said. “Fortnite came out of nowhere a few years ago; now it’s the biggest thing anyone has heard of. You want diversified exposure, and having the ETF approach for it helps mitigate some of those risks in the hit-driven business.”

Image via Roundhill Investments

To encourage investors to add NERD to their portfolios, the fund will offer a fee waiver for the first year of trading, capping the fund’s expense ratio at 0.25%. The firm intends to charge 0.50% per year thereafter.

To read more about thematic ETFs, visit our Thematic Investing Channel.