Lithium prices have been on a tear for most of 2021, but even as prices begin to come back down to earth, industry activity is still picking up.

Prices are being boosted by a movement toward electric vehicles, which require the metal to create batteries for charging. The push for electric has also been boosted by U.S. President Joe Biden’s infrastructure plan that looks to increase the number of electric-powered vehicles on the roads and increase the number of charging stations needed to use them over longer distances.

But what goes up must eventually come down. Lithium prices have begun to stabilize as of late.

“After an active start to the year in terms of lithium prices, the market has started to stabilize in recent weeks,” a Fastmarkets article said. “That is down to a combination of buyers refraining from chasing prices higher, suggesting a degree of destocking, and also as higher prices and a swing round in premiums between different lithium materials have created incentives for convertors to provide what the market wants.”

That isn’t to say the lithium industry is slowing down. As mentioned, supply chain operations are getting some help from the government.

“But, while price activity may have slowed, activity in the lithium industry has picked up,” the article added. “We expect that will now become the norm as the supply chain repositions itself to match supply to demand. The latter is likely to grow at an ever-faster pace as government incentives, government CO2 penalties, consumer choice and general market acceptance that change is upon us, merge to accelerate the move to electrification.”

Playing the Move in Lithium

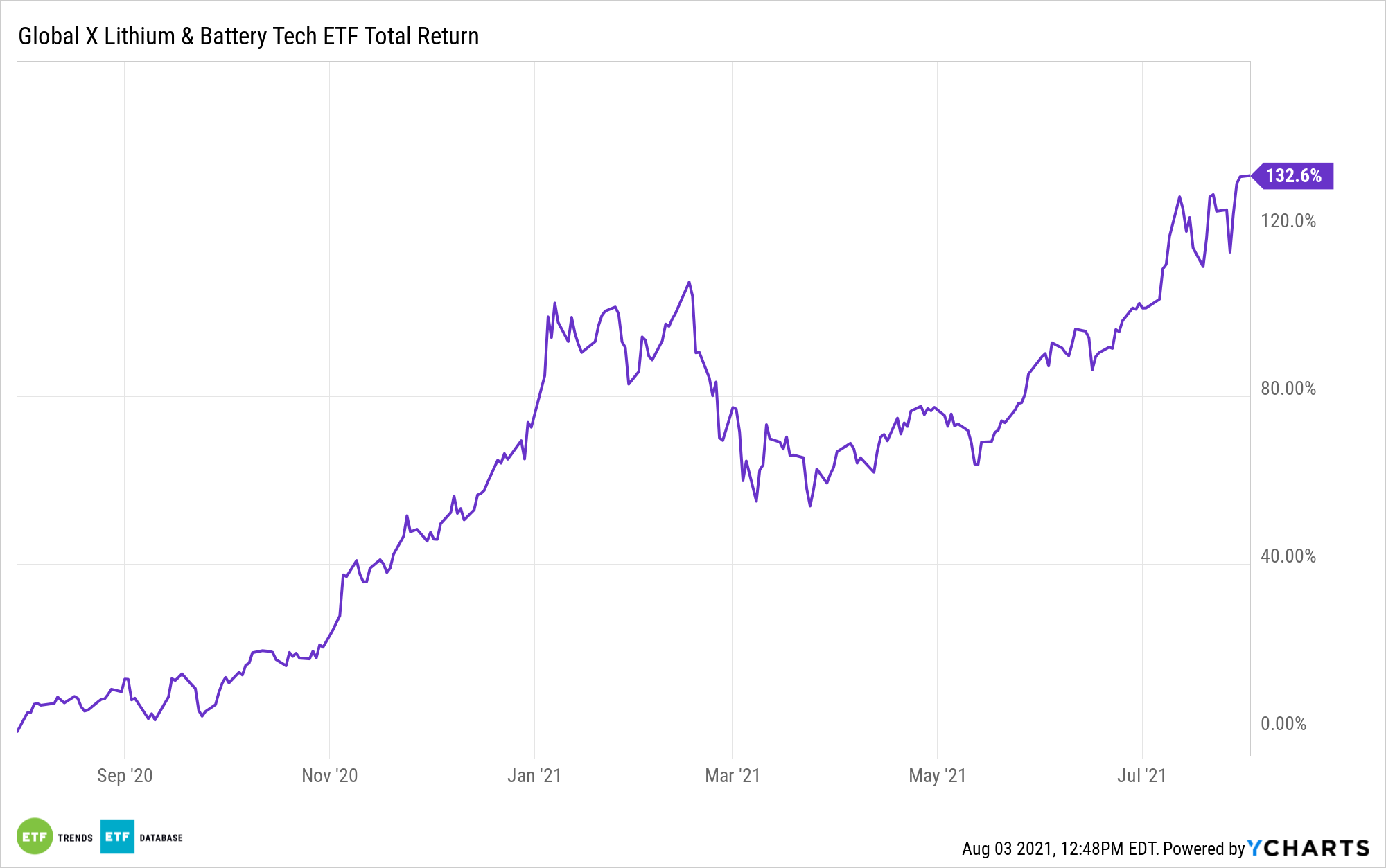

ETF investors can capitalize on the growing lithium industry with funds such as the Global X Lithium & Battery Tech ETF (LIT). LIT seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry.

LIT gives investors:

- Efficient Access: LIT offers efficient access to a broad basket of companies involved in lithium mining, lithium refining, and battery production.

- Thematic Exposure: The fund is a thematic play on lithium and battery technology.

- Exceptional Performance: The fund is up about 140% the past year.

For more news and information, visit the Thematic Investing Channel.