Competition is fierce in the exchange-traded fund (ETF) landscape and differentiation is important for providers seeking to separate themselves from the masses. One trend that’s catching fire is special acquisition companies (SPACs), also referred to as blank check companies.

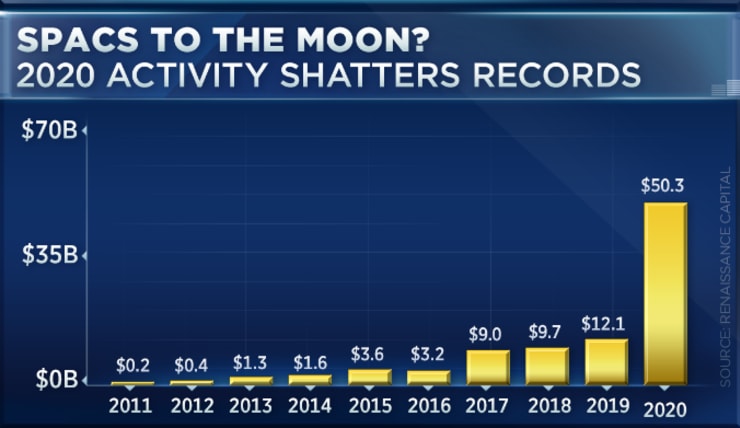

Earlier this month, the SPAC ETF (NYSE: SPAK) was introduced and it’s been embraced by the capital markets with open arms. Per a recent CNBC article, “SPAC activity has exploded this year, with proceeds topping $50 billion, shattering previous records.”

“What we’re providing investors is a combination of those pre-IPO SPACs, the biggest, the most liquid ones that are in anticipation of doing a deal, as well as those post-IPO SPACs that have merged, and those companies that have already IPOed like a DraftKings or a Clarivate,” said Paul Dellaquila, Defiance ETFs President.

“The IPO traditional process is a very closed ecosystem,” he said. “So if you’re an underwriter, if you’re Warren Buffett, if you want to buy Snowflake, you’re in at an $120 price. But once Snowflake actually hits the real market, the secondary market, I’m paying $240 a share or essentially 100% premium on that stock that just a day ago was at 120. So, I think there is a little bit of a closed-off environment to other [registered investment advisor]s, to retail investors, to be able to access those types of investments.”

First Off, What Is a SPAC?

Delving into the space more fundamentally via an Investopedia article, SPACS “are generally formed by investors, or sponsors, with expertise in a particular industry or business sector, with the intention of pursuing deals in that area. In creating a SPAC, the founders sometimes have at least one acquisition target in mind, but they don’t identify that target to avoid extensive disclosures during the IPO process. (This is why they are called ‘blank check companies.’ IPO investors have no idea what company they ultimately will be investing in.) SPACs seek underwriters and institutional investors before offering shares to the public.”

Summary of SPACS per Investopedia:

- A special purpose acquisition company is formed to raise money through an initial public offering to buy another company.

- At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

- Investors in SPACs can range from well-known private equity funds to the general public.

- SPACs have two years to complete an acquisition or they must return their funds to investors.

For more relative market trends, visit ETF Trends.