Miners have played a significant role as a backdoor play on precious metals, and a pair of Global X ETFs have seen strong performances the past month.

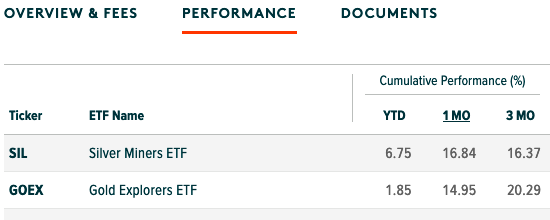

The Global X Silver Miners ETF (SIL) boasts a cumulative gain of about 17% while the Global X Gold Explorers ETF (GOEX) is up about 15%. As inflation fears continue to circulate in the capital markets, early buying of silver and gold could be boosting the funds’ near-term performance.

Rather than buying the commodities themselves, miners are also an option for ETF investors seeking to get in on the precious metals action. Miners can offer less exposure to price volatility, particularly when heavy selling can push prices lower swiftly.

SIL has gained about 17% the past few months. Per the fund’s description, SIL seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index. Despite the recent weakness in silver, SIL is still up 55% over the last 12 months.

Up about 20% the past few months, GOEX seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Gold Explorers & Developers Total Return Index, which is a free float-adjusted, liquidity-tested and market capitalization-weighted index that is designed to measure broad-based equity market performance of global companies involved in gold exploration.

Bullish Dip-Buying?

As the capital markets keep their eyes on the Federal Reserve and their interest rate policy, bullish precious metals investors can take advantage of the dip. The start of the trading week saw bulls come in and purchase significant precious metals, according to Kitco News.

“Gold and silver prices are modestly higher in midday U.S. trading Monday, as traders saw early price pressure as a bargain-buyer opportunity and they stepped up,” Kitco News said. “Still, the safe-have metals see little risk aversion in the global market place at present and that could limit the upside in the near term. August gold futures were last up $6.20 at $1,897.00 and July Comex silver was last up $0.129 at $28.025 an ounce.”

For more news and information, visit the Thematic Investing Channel.