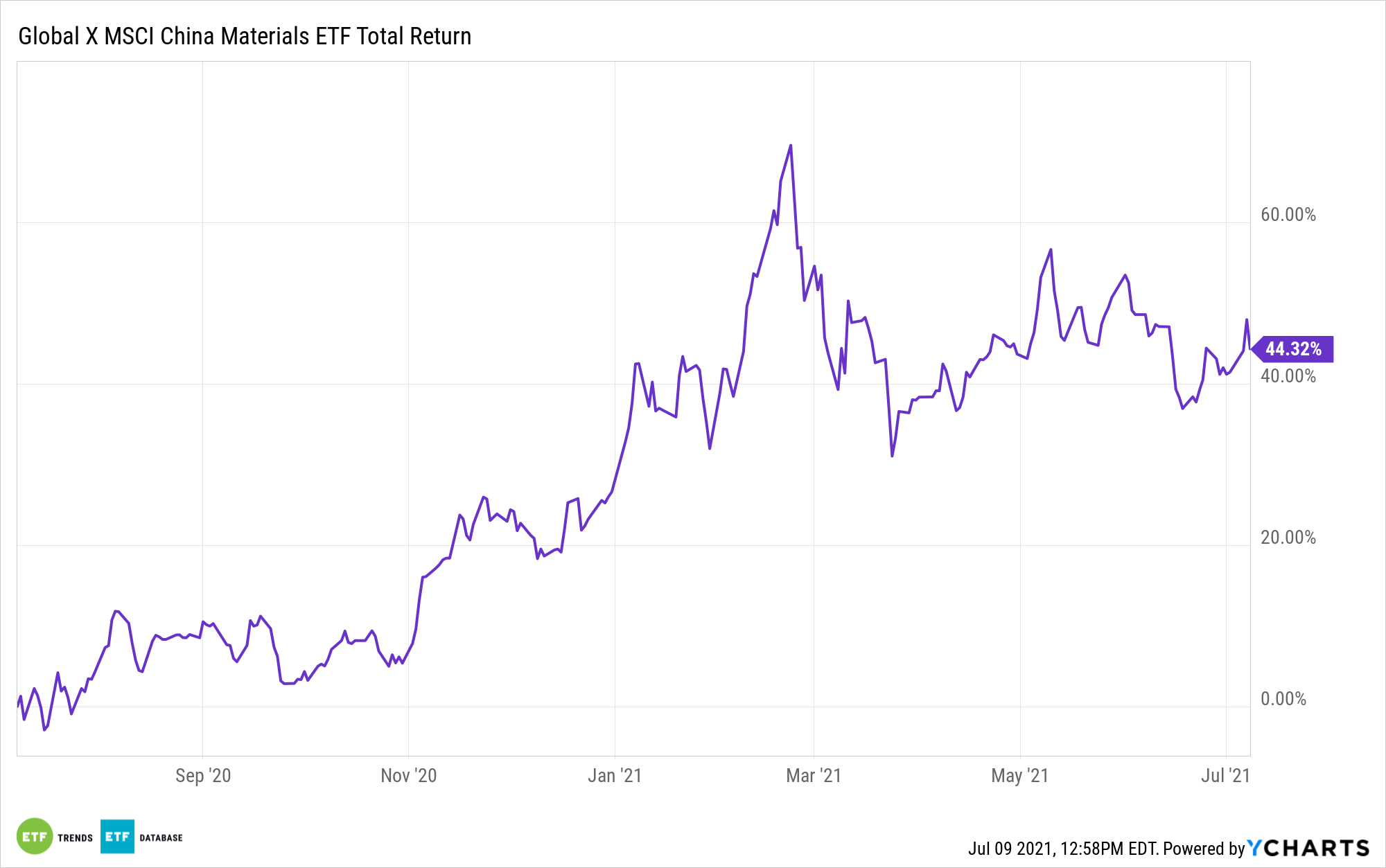

As the world enters the second half of 2021, look for infrastructure demand to be a key mover for the Global X MSCI China Materials ETF (CHIM).

“Infrastructure relies heavily on basic materials like cement, steel, copper and more,” a Global X analysis said. “For example, copper’s electrical conductivity makes it widely used in wiring, while steel is a crucial component to make sturdy frames for buildings.”

“China’s immense infrastructure needs have been a boon for the Materials sector,” Global X explained.

CHIM seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Materials 10/50 Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index.

The underlying index tracks the performance of companies in the MSCI China Index that are classified in the materials sector, as defined by the index provider. Those looking to overweight China may find this ETF useful for fine-tuning exposure, especially those expecting strong performance from the industrial sector.

Investors bullish on the outlook for industrial stocks but hesitant to invest in U.S. equities can consider CHIM as well.

CHIM gives investors:

- Targeted Exposure: CHIM is a targeted play on the Materials Sector in China, the world’s second largest economy by GDP.

- ETF Efficiency: In a single trade, CHIM delivers access to dozens of materials companies within the MSCI China Index, providing investors with an efficient vehicle to express a sector view on China.

- All Share Exposure: The Index incorporates all eligible securities as per MSCI’s Global Investable Market Index Methodology, including China A, B, and H shares, Red chips, P chips and foreign listings, among others.

Lofty Transportation Goals

Adding more fuel to infrastructure will be China’s ambitious transportation goals. The country is investing heavily in its infrastructure to improve transportation, including a cross-country, high-speed railway.

“After building out roads, bridges, tunnels, airports and more, China took on the enormous task of building high-speed railways across the country,” Global X continued. “To give an idea of how quickly that infrastructure was built out, the length of China’s high-speed railway network went from a mere 1,000km in 2009 to 35,000km in 2019.

“In times of economic pressure, infrastructure spending has been one of China’s go-to tools to stimulate the economy, as evidenced by its infrastructure binges after the 1997 Asian financial crisis and 2008 global financial crisis,” the article added.

For more news and information, visit the Thematic Investing Channel.