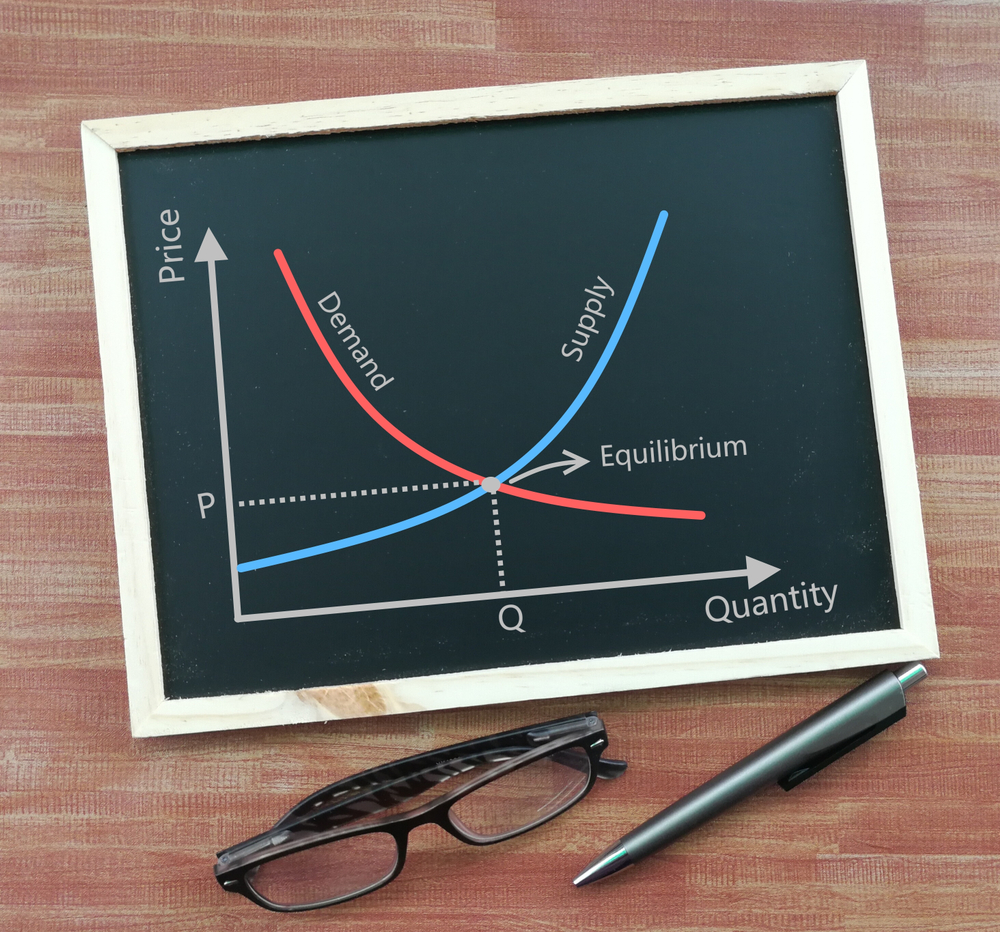

Simple forces of supply and demand are feeding into strength for the Global X Lithium & Battery Tech ETF (LIT). Electric automaker Tesla is demanding more lithium for its cars, but a supply shortage is boosting lithium prices.

Despite beating Wall Street expectations with revenue, Tesla missed the mark on its earnings per share (EPS) during its fourth-quarter earnings report two weeks ago. One of the reasons Tesla CEO Elon Musk cited for the earnings miss was s lack of lithium battery supply to meet its demand.

Tesla’s Q4 results:

- Earnings: 80 cents adj. vs $1.03 per share expected

- Revenue: $10.74 billion vs $10.4 billion expected

This, in turn, put new products on hold. Tesla’s semi truck is one of them. On its website, Tesla touts the semi as “the safest, most comfortable truck ever. Four independent motors provide maximum power and acceleration and require the lowest energy cost per mile.”

“The main reason we have not accelerated new products like the Tesla Semi is that we simply don’t have enough cells built,” Musk said. “We could easily go into the production of the Semi, but we don’t have enough cells for it right now.”

LIT seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry. LIT gives investors:

- Efficient Access: LIT offers efficient access to a broad basket of companies involved in lithium mining, lithium refining, and battery production.

- Thematic Exposure: The fund is a thematic play on lithium and battery technology.

- Strong performance: the fund is up over 130% within the past year

LIT Charged Up By Its Top Holdings

When popping the hood of LIT, Albemarle Corp, Gangfeng Lithium, and Tesla dominate the fund’s assets at almost 25%. With Tesla up over 460% and Gangfeng Lithium up almost 400%, it’s easy to see why LIT has been such a strong performer the past year.

As noted, one of LIT’s top holdings is Gangfeng Lithium Company, which gives investors additional international exposure to China. The second largest economy is looking to make all vehicles sold by 2035 to be electric.

“When it comes to global automakers’ electric vehicle plans, all roads lead back to Beijing,” said Michael Dunne, a former president of G.M.’s Indonesia operations, in a New York Times article.

For more news and information, visit the Thematic Investing Channel.