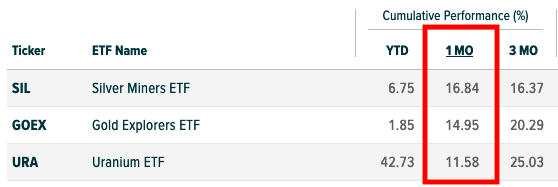

Metals have been the strongest performers the past month when looking at the top gainers in Global X’s thematic ETF stable.

With the Federal Reserve deciding to stand pat on interest rate raises until 2023, investors could be moving back into metals again. Global X funds focusing on silver, gold exploration, and uranium have all jumped.

The top performer the past month has been the Global X Silver Miners ETF (SIL). SIL seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index.

Furthermore, the fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) based on the securities in the underlying index. The underlying index is designed to measure broad-based equity market performance of global companies involved in the silver mining industry.

Next up is the Global X Gold Explorers ETF (GOEX), which also boasts a strong year-to-date performance. This fund seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Gold Explorers & Developers Total Return Index, which is a free float-adjusted, liquidity-tested and market capitalization-weighted index that is designed to measure broad-based equity market performance of global companies involved in gold exploration.

Lastly, there’s the Global X Uranium ETF (URA), which is gaining strength as a probable renewable energy source. URA seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index.

The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) based on the securities in the underlying index. The index is designed to measure broad based equity market performance of global companies involved in the uranium industry.

For more news and information, visit the Thematic Investing Channel.