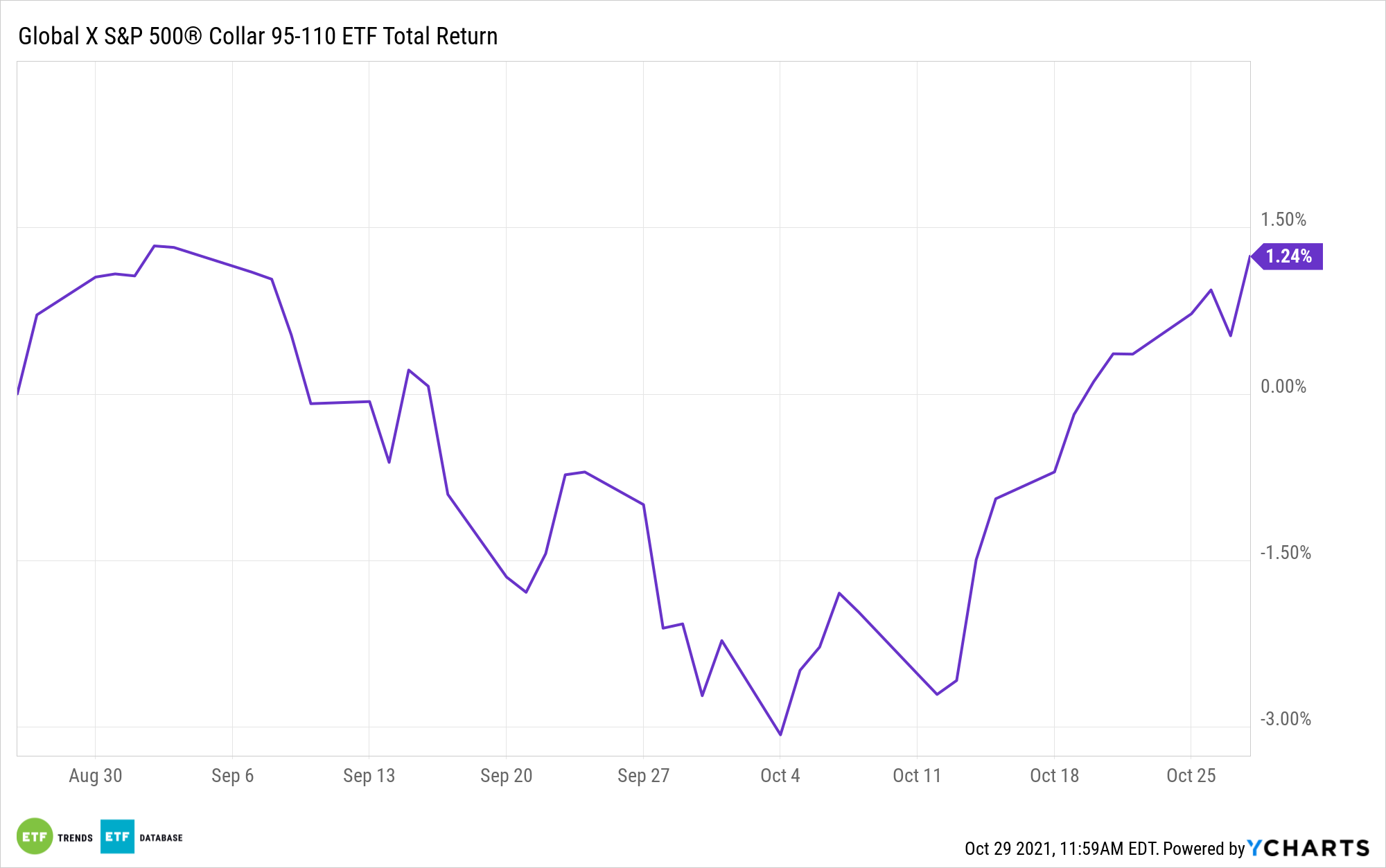

Growth beginning to make a comeback and forthcoming volatility in the markets could be handled by using an ETF that addresses both with a collar strategy.

Investors looking to use the tricks of the trade to the fullest can utilize a collar strategy as part of their own risk management measures. Inflation fears have been known to rack the markets as of late, so using a collar strategy could help protect against future market downturns.

“A collar, also known as a hedge wrapper or risk-reversal, is an options strategy implemented to protect against large losses, but it also limits large gains,” Investopedia explained.