Hedge funds are typically mum when it comes to revealing their profitable strategies, but Global X offers an exchange traded fund (ETF) that retail investors can access.

Just before 2021 came to a close, hedge funds around the world were set to end the year on a positive note. It was a stark contrast from the two previous years.

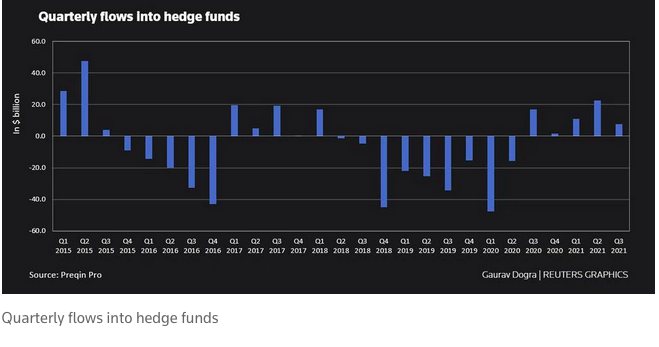

“Global hedge funds are poised to achieve positive inflows in 2021, for the first time in three years, data from Preqin shows, thanks to strong returns and an investor shift to alternative assets during a period of volatility and rising inflation,” Reuters reported on December 15. “Alternative assets data and analytics firm Preqin’s data shows hedge funds have attracted flows totaling $40.9 billion in the first three quarters of the year, after outflows of $97.2 billion and $44.5 billion in 2019 and 2020 respectively.”

With inflation already in full swing, investors are looking towards hedge funds to diversify.

“Investors are looking to hedge funds to achieve a measure of diversification, particularly considering that the specter of inflation has recently entered the fray,” Benjamin Crawford, vice president and head of research at alternate investment data firm BarclayHedge, said.

“Several sectors of the hedge fund industry have a well-earned reputation for shielding assets from inflation.”

Getting Hedge Fund Exposure in One ETF

Investors looking for exposure to hedge fund strategies can get it all in the Global X Guru Index ETF (GURU). The fund seeks investment results that correspond to the Solactive Guru Index, which invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) based on the securities in the underlying index.

The underlying index is comprised of the top U.S.-listed equity positions reported on Form 13F by a select group of entities characterized as hedge funds. To sum it all up, GURU gives ETF investors:

- Ideas: GURU allows everyday investors to access the high conviction investments of some of the largest, most sophisticated hedge funds in the world.

- Alpha potential: By investing alongside hedge funds, GURU seeks to benefit from their top tier research and knowledge to outperform U.S. equity benchmarks such as the S&P 500.

- Cost efficiency: Traditionally, investing with a hedge fund requires paying an ongoing 2% management fee and 20% of profits. GURU has an expense ratio of 0.75%, potentially allowing for greater cost efficiency, while providing access to hedge fund ideas.